In key news on UK stocks, FTSE 100-listed medical technology company Smith & Nephew PLC (GB:SN) anticipates higher margins in 2024. In the full-year results for 2023, the company reported a trading profit margin of 17.5%, up from 17.3% in 2022. It expects the trading profit margin to reach at least 18% in 2024.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Revenue Growth and Positive Outlook

Smith & Nephew manufactures and sells medical devices. The company’s full-year revenue of $5.5 billion grew 7.2% on an underlying basis in 2023 and surpassed expectations. Among its segments, SN’s Orthopedics business witnessed 5.7% underlying growth.

The Sports Medicine & ENT segment experienced a robust 10% underlying growth despite facing pressure from the Chinese market due to the government’s volume-based procurement policy. Meanwhile, the Advanced Wound Management segment generated a 6.4% underlying revenue growth.

Overall, the company benefitted from strong demand for medical equipment, particularly from older adults, who are now resuming surgeries that were postponed during the pandemic.

In the upcoming year, Smith & Nephew anticipates that positive factors will outweigh challenges such as persistent inflation and the slowdown in China. For 2024, the underlying revenue growth is expected in the range of 5% to 6%. The company is also bullish on its 12-point plan, which is expected to offset the macro challenges. This plan, announced in 2022, aims to achieve more growth through strategic investments in advanced technologies and productivity enhancements.

Is Smith & Nephew a Good Stock to Buy?

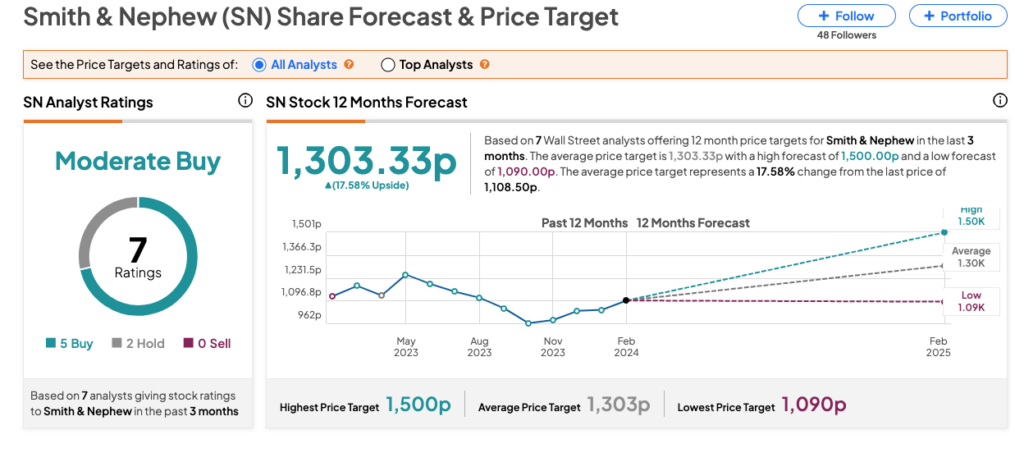

According to TipRanks’ consensus, SN stock has received a Moderate Buy rating, backed by a total of seven recommendations. It includes five Buy and two Hold ratings. The Smith & Nephew share price forecast is 1,303.33p, which is 17.6% above the current trading levels.