In major news on UK stocks, Reckitt Benckiser Group PLC (GB:RKT) shares rose nearly 5% as of writing, after the company reported upbeat Q1 results, fueled by its hygiene brands like Dettol, Lysol, and Harpic. In the first quarter, net revenue growth on a like-for-like (LFL) basis stood at 1.5%, with a volume decrease of 0.5% and a price/mix growth of 2.0%. The hygiene division experienced revenue growth of 7.1%, offsetting a 9.9% decline in the nutrition segment.

Reckitt is a multinational consumer goods company specializing in health, hygiene, and nutrition products.

Reckitt’s “Good” First Quarter

Reckitt’s CEO, Kris Licht, described the first quarter as “good.” He highlighted that Q1’s performance was boosted by continued pricing strategies and consumers upgrading to its premium innovations. He further stated that now the company is transitioning to a more balanced approach, considering price, mix, and volume contributions.

Overall, the company’s net revenue declined 4.6%, as LFL growth was hindered by exchange headwinds of 5.7%.

For the full year, Reckitt reaffirmed its guidance, projecting like-for-like revenue growth between 2% and 4%, with adjusted operating profit expected to outpace net revenue growth.

Analysts’ Reactions

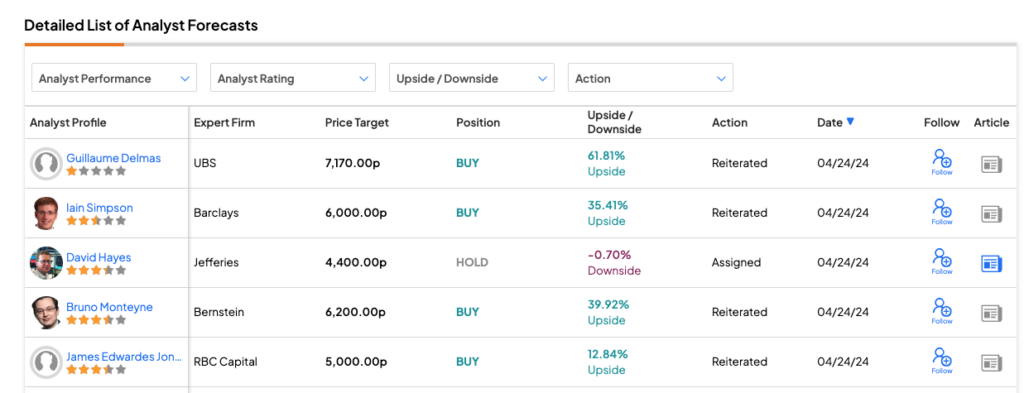

Following the update, many analysts confirmed their ratings on Reckitt stock, with a majority of Buy recommendations. Analysts at UBS, Barclays, Bernstein, and RBC Capital reiterated their Buy ratings. Guillaume Delmas from UBS predicts the highest upside of 62% in the share price.

Meanwhile, Jefferies analyst David Hayes upgraded his rating for RKT stock from Sell to Hold. Hayes increased the price target to 4,400p from 4,100p. His bullish sentiment towards RKT stock is primarily driven by reduced assumptions regarding the U.S. litigation liability risk. In March, Reckitt was charged with $60 million in a lawsuit concerning its baby formula Enfamil in the U.S.

Is Reckitt Benckiser a Good Stock to Buy?

According to TipRanks’ analyst consensus, RKT stock has received a Moderate Buy rating, backed by a total of 17 recommendations, including nine Buys. The Reckitt share price forecast is 5,510.0p, which is 25% higher than the current price level.