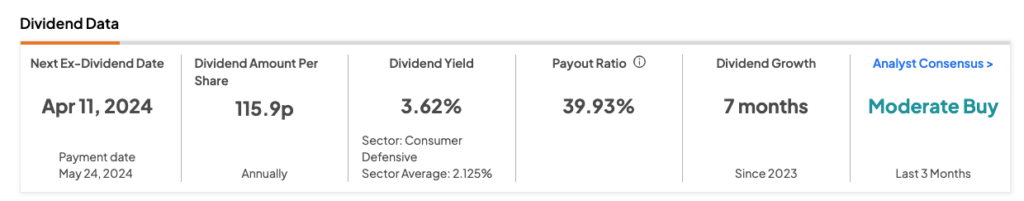

Among popular UK stocks, Reckitt Benckiser Group PLC (GB:RKT) is known for providing stable dividends to its shareholders. Recently, in its 2023 annual results, the company increased its full-year dividend to 192.5p, up by 5% from the previous year. The annual dividend was skewed towards the second half of the year, with the final dividend rising to 115.9p per share from 110.3p in the previous year.

The final dividend is payable on May 24 to the shareholders registered before April 11, 2024.

The latest earnings season has delivered various surprises, including dividend hikes. The TipRanks Earnings Calendar provides an easy way for users to track companies’ recent and upcoming earnings announcements. Additionally, TipRanks offers a range of dividend tools, streamlining the process of selecting high dividend-paying stocks within specific markets.

Reckitt’s Dividend Yield

Reckitt is a multinational consumer goods company renowned for its extensive audience reach and brand power. Some of its well-known brands include Dettol, Harpic, Lysol, Strepsils, and more.

Currently, the company offers a dividend yield of 3.62%, above the sector average of 2.13% and close to the FTSE 100 average dividend yield of 3.78%. What adds to Reckitt’s attractiveness is its consistent dividend payouts. Over the last five years, Reckitt has maintained an average yield of over 2.5%.

2023 Results Snapshot

For the full year, Reckitt achieved net revenue of £14.6 billion, marking 3.5% growth on a like-for-like (LFL) basis. The rise was primarily propelled by a 7.8% price increase, although it was offset by a 4.3% decrease in volumes. Free cash flow rose to £2.26 billion, marking an increase of 11.2%.

In 2023, the company faced a £55 million annual revenue setback due to a compliance issue in the Middle East. However, the company stated that this would not affect its outlook for 2024 or its other mid-term objectives.

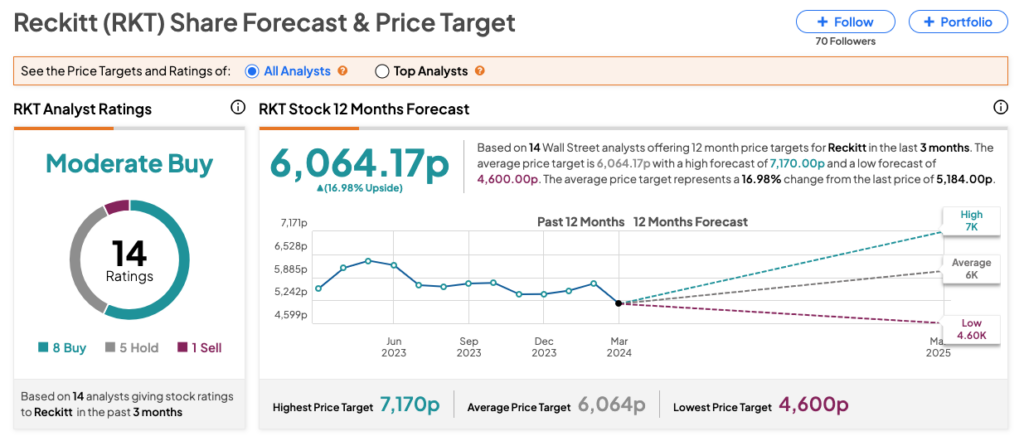

Is Reckitt Benckiser a Good Stock to Buy?

RKT stock stayed stable over the last 5 years but recently plummeted after a sharp decline in its 2023 profits. Year-to-date, the stock has lost almost 6% in trading.

According to TipRanks’ analyst consensus, RKT stock has received a Moderate Buy rating backed by 14 recommendations, including eight Buys. The Reckitt share price forecast is 6,064.17p, which is 17% higher than the current price level.