In key news on UK stocks, Anglo American PLC’s (GB:AAL) shares are on the rise after Reuters reported that the FTSE 100-listed miner Glencore PLC (GB:GLEN) is considering bidding for the company, which could lead to a potential bidding war. Glencore has reportedly conducted internal discussions, which may not necessarily result in an offer for Anglo. Meanwhile, a Glencore spokesperson said that the company refrains from commenting on any rumour or speculation. As of the latest update, Anglo’s shares are up by 3.3%, whereas GLEN’s shares dipped by 1.3%.

Based in the UK, Anglo American is a leading producer of platinum, with a product lineup that includes diamonds, copper, and iron ore.

Potential Bidding War for Anglo American

Last week, Anglo American rejected the $38.8 billion offer of Australia-based BHP Group Limited (AU:BHP), stating that it was undervalued and unappealing. BHP’s bid attracted a lot of attention, with criticism coming from both the South African government and shareholders regarding its offer. Reuters also reported that BHP is exploring options to present an improved offer for Anglo. BHP has until May 22 to submit a formal bid.

Additionally, BHP’s offer was contingent on its spin-off of Anglo’s two units – Anglo American Platinum and Kumba Iron Ore.

Jefferies analyst Christopher LaFemina believes that Glencore could reap advantages by offering a simple all-share deal that excludes Kumba and Amplats demergers. This approach would allow Glencore to leverage Kumba and engage in iron ore marketing, unlike BHP. Additionally, it could lead to reduced political resistance in South Africa.

The Battle for Copper Assets

Anglo is currently on the radar of its competitors, considering its valuable copper mines in Chile and Peru. Globally, there has been a surge in demand for copper, as the metal plays a crucial role in various sectors driving economic growth. From renewable energy initiatives to electric vehicle manufacturing to AI-driven data centers, copper is indispensable. Consequently, demand for copper is anticipated to continue rising along with its price.

Is Anglo American a Good Share to Buy?

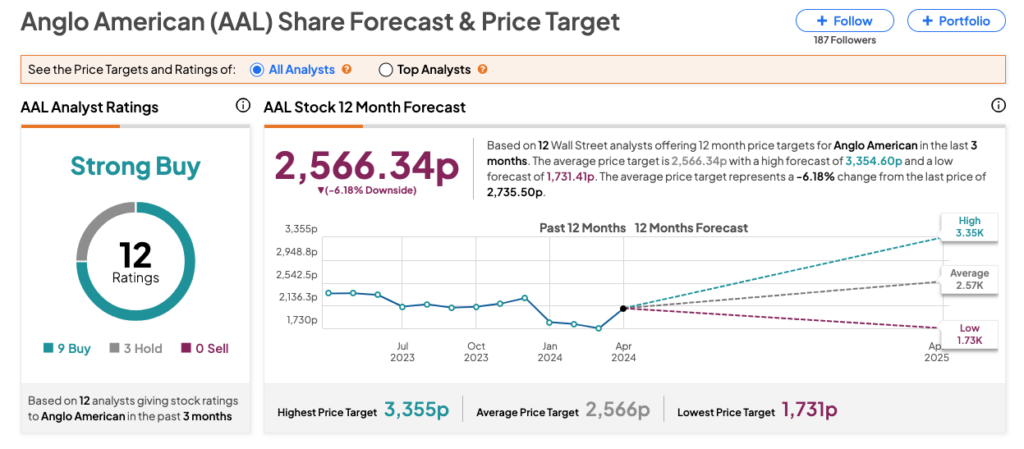

According to TipRanks’ consensus, AAL stock has been assigned a Strong Buy rating, backed by nine Buy and three Hold recommendations. The Anglo American share price target is 2,566.34, which is 6% below the current trading price.