In a recent move, the Bank of England decided to implement a more hawkish approach by raising interest rates by 50 basis points. The UK’s top four banks, HSBC Holdings (GB:HSBA), Barclays (GB:BARC), Lloyds Banking (GB:LLOY), and NatWest Group (GB:NWG), were all trading in the red zone yesterday after the rate hike announcement. However, analysts are highly bullish on these stocks and predict huge upside potential.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Most of the UK banking stocks have experienced a decline this year, primarily due to the anticipation of intensified competition among lenders to attract deposits by offering higher interest rates to savers. Policymakers are delicately navigating a challenging situation as they strive to tighten monetary policy while avoiding the risk of triggering a severe mortgage crisis and economic downturn. The country’s inflation rate was stable at 8.7% in May 2023.

Let’s take a look at the details.

What is the Future price of Barclays stock?

Two days ago, Marco Nicolai from Jefferies confirmed his Buy rating on the stock, predicting a huge upside of 117% in the share price.

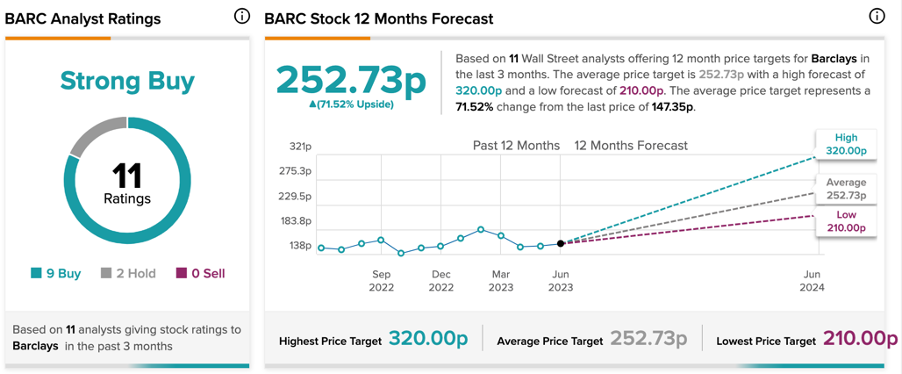

Overall, BARC stock has a Strong Buy rating on TipRanks at a price target of 252.73p, which is 71.5% higher than the current price. The stock has a total of 11 recommendations, which include nine Buy and two Hold ratings.

YTD, the stock has been trading down by 7.25%.

Is HSBC a Buy, Sell, or Hold?

Yesterday, five-star-rated analyst Benjamin Toms from RBC Capital reiterated his Buy rating on the stock with a 32% growth forecast in the share price.

On TipRanks, HSBA stock has a Moderate Buy rating, based on eight Buy and four Hold recommendations. The average target price is 779.5p, which is 28.5% higher than the current trading price.

Is Lloyds Bank a Good Stock to Buy?

Following a 5% increase over the last year, Lloyds’ stock has witnessed a YTD decline of 4.12% in trading.

Yesterday, Exane BNP Paribas downgraded the bank’s rating from Buy to Hold at a price target of 52p. This shows a 21% increase in the share price from the current level. Analyst Guy Stebbings commented, “Back in the danger zone,” as he feels the UK banks have peaked in earnings driven by higher interest rates.

LLOY stock also carries a Moderate Buy rating on TipRanks, backed by a total of nine recommendations. At an average price forecast of 63.88p, analysts predict a growth of 48.5% in the share price.

Is NatWest Shares a Buy?

Stebbings also downgraded the rating on NWG from Hold to Sell yesterday. His price target of 280p still indicates an increase of 21% in the share price.

On the contrary, NWG stock has a Moderate Buy rating on TipRanks based on nine Buy, Three Hold, and one Sell recommendations. The average price target is 372.3, which is 61% above the current trading level.

Conclusion

The UK banking stocks are back in the limelight, as the lenders are encountering a challenging situation as interest rate increases adversely impact the prospects of both loans and deposits.

Banks are expected to face challenges in 2023, including slower income growth, cost pressures, and larger provisions. However, the majority of banks are anticipated to witness profit growth in the current year. Analysts remain optimistic about these banks as stable investment choices in the UK market.