Spanish companies Industria de Diseño Textil, S.A. (ES:ITX) and Cellnex Telecom SA (ES:CLNX) have begun the year on a good note. As per the TipRanks Smart Score tool, they have high scores, which indicates a solid potential to surpass market returns.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

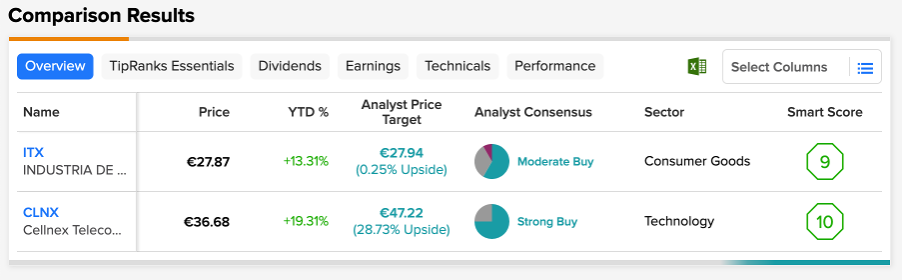

In analyzing these two stocks, we have used the TipRanks Stock Comparison tool for Spain to compare them on different parameters like Smart Score. According to this, a score is assigned to every stock based on the data derived from eight different factors, like ratings, news sentiment, insider activity, etc. The stocks with a score of eight, nine, or ten have more chances to beat the overall market returns.

Let’s discuss these stocks in detail.

Industria de Diseño Textil, S.A. (Inditex)

Inditex is a global clothing company that owns brands like Zara, Pull&Bear, Massimo Dutti, and more. The brands have a presence in around 215 markets.

The company’s stock gained good momentum in the last six months, with 16% returns.

In its interim results for the first nine months of 2022, the company posted a solid operating performance. The sales increased by 19% to €23.1 billion, as compared to the same period last year. The gross margin reached 58.7% as a result of the strong execution of strategies. The company did face some challenges in controlling its operating costs, which increased by 17% during this period. But the net income was up by 24% to €3.1 billion.

Analysts are optimistic about the stock for two main reasons: firstly, Inditex increased its production and kept a higher inventory, and secondly, its prices increased across major segments.

The company is betting big on its online sales and targets them to exceed 30% of total sales by 2024. Also, the company has started charging for online returns, which will support its bottom line.

The company will report its full-year earnings on March 15, 2023.

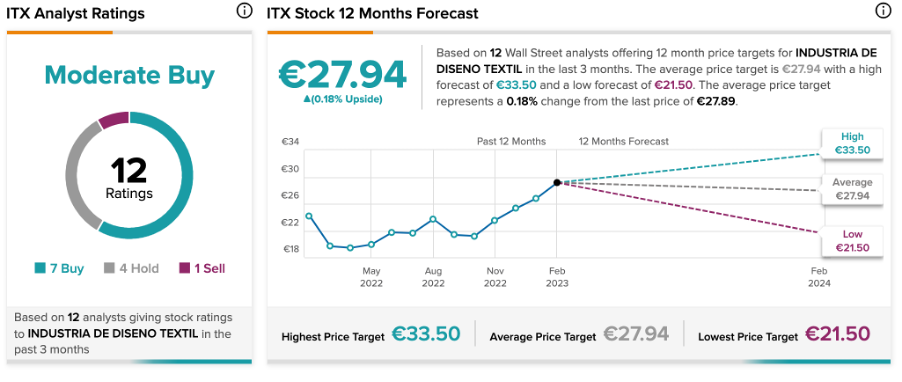

Inditex Stock Price Target

Based on a total of 12 ratings, Inditex stock has a Moderate Buy rating on TipRanks.

The average target price is €27.94, which is similar to the current price levels.

Cellnex Telecom SA

Cellnex is a leading telecommunications company, providing services across Europe.

After falling by around 7% in the last year, the stock has gained 16% YTD. Recently, in January, the company stock soared by almost 10% after the potential takeover news was reported by American Tower (NYSE:AMT) and Brookfield (NYSE:BN).

In the first three quarters of 2022, the company posted a growth of 46% in its revenues of €2.5 billion, and its earnings grew by 45% as compared to the same period in 2021.

Analysts are highly bullish on the stock due to its strong clarity of future earnings and solid financial health. The company is positive about generating positive cash flow after 2024 and becoming debt-free by 2027.

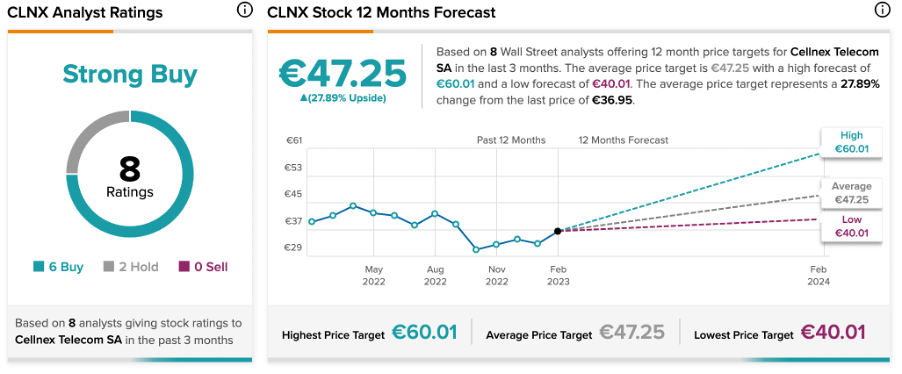

This justifies Cellnex’s “Perfect 10” on the Smart Score tool.

Is Cellnex a Good Investment?

According to TipRanks’ analyst consensus, CLNX stock has a Strong Buy rating. The rating is based on six Buy and two Hold recommendations.

The average price target is €47.25, which shows an upside potential of 28%.

Conclusion

Inditex and Cellnex have a score of nine and ten, respectively, on the TipRanks Smart Score tool. The analyst’s view and rating clearly justify these scores. Among both, Cellnex has more upside potential in its stock price and could be a safe option for investors.