Using the TipRanks Best Australian Dividend Stocks tool, we have shortlisted two companies from the ASX 200 list that are apt for value investors. Woolworths Group (AU:WOW) and National Australia Bank (AU:NAB) have higher dividend yields than their respective industry averages. This provides an attractive opportunity for investors to boost their passive income.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Let’s take a look at these companies in detail.

Woolworths Group Ltd.

Woolworths Group is an Australian retail company with a portfolio of various trusted brands in groceries, pet supplies, and health products. The company is known for its leading position in the market, its brand loyalty among customers, and its consistent dividend payments.

The company is in the process of transitioning back to normal operations after being hit by the pandemic and lockdowns. In the first quarter of 2023, total sales increased by 1.8% to AU$16.3 billion; however, group e-commerce sales were down by 14.5% to AU$1.6 billion. As a countermeasure to rising food prices, the company continued with a price hike of 7.3% in Australian food and 5.3% in New Zealand food. Even though the company believes the inflation numbers may come down, it believes it could take more time for consumers to actually see the difference.

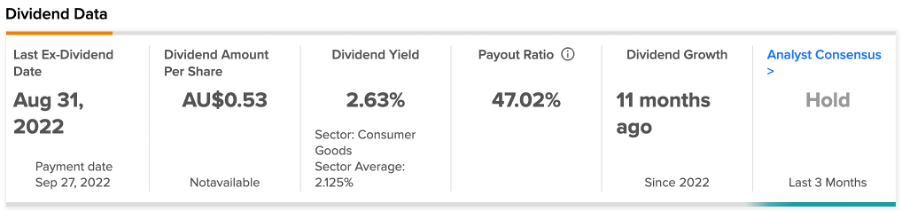

Peeking into its dividends, Woolworths has a dividend yield of 2.63%, while the sector average is 2.12%. In 2022, the company paid a total dividend of AU$0.92 per share, which was 1.1% higher than in 2021.

Goldman Sachs has forecasted a fully franked dividend of AU$1.02 per share for 2023 and AU$1.13 per share for 2024. Analyst Lisa Deng believes that the company has the ability to improve its market share, driven by its loyal customer base. The company also has the advantage of passing on higher costs to customers and protecting its margins.

Deng has a Buy rating on the stock and sees an upside potential of 14% on the current price.

Woolworths Share Price Forecast

The stock has gained around 11.2% in the last three months. The average target price is AU$34.82, which shows a downside of 4.64%.

According to TipRanks’ analyst consensus, WOW stock has a Hold rating.

National Australia Bank Limited

National Australia Bank (NAB) is among the largest banks in Australia.

NAB’s stock has gained a good 21% in the last year, mainly driven by rising interest rates in the economy. Currently, analysts feel the price will stabilize and don’t see any significant upside.

Nonetheless, the stock is still an attractive option for investors looking for consistent dividends. NAB’s dividend yield is 4.8% as compared to the sector average of 2.1%.

For the full year 2022, the bank declared a final dividend of AU$0.78 per share fully franked, pushing the total dividend to AU$1.51 per share. This represents a growth of 24% over the previous year.

For the fiscal year 2023, analysts expect an annual dividend of AU$1.71 per share. Analysts believe the profits will further increase in 2023, as the bank has hiked its interest rates for borrowers. The bank is expected to deliver earnings of AU$2.5 per share in 2023, which will allow it to fund its higher dividend payments.

In its full-year results for 2022, cash earnings increased by 8.3% to AU$7.1 billion.

IS NAB Stock Buy or Sell?

According to TipRanks, NAB stock has a Moderate Buy rating, based on recommendations from 10 analysts. This includes six Buy, three Hold, and one Sell ratings.

The average target price is AU$32.16, which is almost similar to current trading levels.

Conclusion

While choosing dividend stocks, it is important to assess the future earnings of the company to see if they can support stable dividend payments.

Both, Woolworths and NAB look favorable in terms of their earnings in 2023, which gives confidence about their future dividends. These two stocks could be a decent option for investors to keep their income stable.