Germany has produced some of the best-known cars in the world. Their brands are reliable, stylish, and of the best quality. Over the years now the automobile industry has attracted a lot of investors. However, the landscape is changing with the adoption of electric vehicles (EV) and hybrid models in the market. The big players are now all competing to dominate the EV space.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The global market for EVs is still underdeveloped, leaving huge scope for manufacturers to mark their territory.

Considering this backdrop, we have used the TipRanks Stock Screener tool for the German market to pick three automobile giants, Volkswagen (DE:VOW3), Mercedes-Benz Group (DE:MBG), and Bayerische Motoren Werke Aktiengesellschaft (DE:BMW). This tool comprises all the stocks from different markets and can be screened on the basis of different parameters.

Let’s take a look at these companies in detail.

Volkswagen

The Volkswagen Group has some top-class brands like Volkswagen, Skoda, Audi, Bentley, Ducati, Lamborghini, and many more under their umbrella.

The stock has been on a downward journey since the global COVID-19 pandemic and the lockdowns. After a slight recovery, the stock gained some momentum after the company announced increasing its production and market share for electric vehicles (EV). Since then, it has been a shaky ride for the stock, which has fallen by 19% in the last year.

The company is aggressively pursuing its goal of transitioning to electric vehicles. It even announced plans to move completely to an EV portfolio in Europe in 2033. The company is, however, facing supply disruptions since the outbreak of the war in Ukraine, which is affecting production targets.

The company still managed a 25% increase in the delivery of all-electric vehicles, as reported in its interim report for 2022. The management remains confident in the company’s ability to withstand macroeconomic challenges and prove its resilience again.

Volkswagen Stock Forecast

TipRanks rates Volkswagen stock as a Moderate Buy, with six Buy, four Hold, and one Sell recommendation.

The average VOW3 target price is €186.6, with an upside potential of 35.4%.

Bayerische Motoren Werke Aktiengesellschaft (BMW)

German-based BMW is among the leading manufacturers of luxury and premium automobiles in the world. Its brands include BMW, Rolls-Royce, MINI, and BMW Motorrad.

Being a premium car maker, BMW caters to the affluent class and is less affected by the recessionary pressures in the economy. This was quite visible in its stock prices, which were doing fairly better than those of its competitors. The stock has been trading up by 3% in the last year and by 30% in the last three years.

Moving on to the EV battle, BMW is also at the forefront to capture a higher market share. Despite the troublesome environment for the EV players, the company managed to double its EV sales in the first half of 2022, with a total of 75,891 units sold across the world.

Will BMW Stock go up?

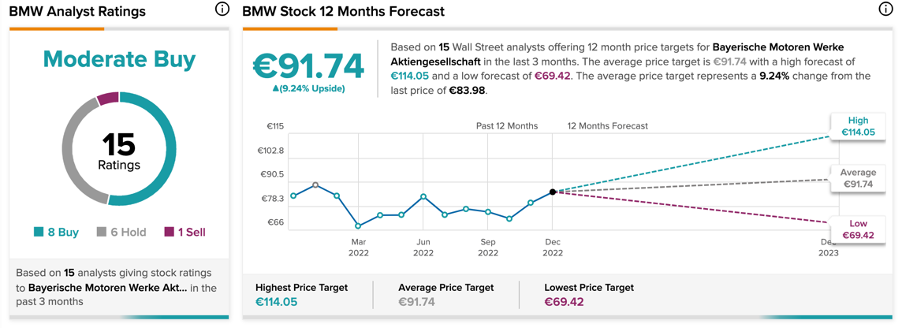

According to TipRanks’ rating consensus, BMW stock has a Moderate Buy rating.

The BMW target price is €91.7, which is 9.2% higher than the current price level. The target price ranges from a low of €69.42 to a high of €114.05.

Mercedes-Benz Group

Another player in the German market is the Mercedes-Benz group, known for its luxury cars and commercial vehicles worldwide.

The company painted an impressive picture with its third-quarter figures in 2022. The revenue jumped to €37.7 billion, up by 19% from the third quarter of 2021. Earnings before taxes increased by a huge 83% to €5.2 billion. The results clearly depict a huge demand for the company’s products, such as the premium and EV models. The company’s passenger car BEV (battery electric vehicles) sales saw a whopping jump of 183% in the third quarter.

Mercedes has also announced its shift to all-electric by 2030 as part of its aim toward an emission-free future. It is investing €40 billion under this plan to ramp up its production network, among other things.

Is Mercedes Stock a Buy?

As per the TipRanks database, the Mercedes stock has a Strong Buy rating with 15 Buy recommendations.

The analysts expect a 24% hike in the share prices, with an average price target of €80.14. The high and low forecasts for the price are €99.1 and €64.4, respectively.

Conclusion

The automobile industry is currently facing certain headwinds with supply and logistics issue affecting their EV productions and profitability in the short term. However, the numbers are expected to further improve for the fourth quarter of 2022.

These three giants, with their desirable product lines and an eye toward a larger EV market share, make their stocks highly attractive.