In stressful market scenarios, investors may find it difficult to cherry-pick stocks. Just following one’s technical or fundamental research may not be enough to pick the best. At such times, the TipRanks Smart Score tool comes in handy and helps investors gauge stocks based on eight different parameters. These include technical and fundamental factors, as well as views of financial analysts, bloggers, hedge funds, and corporate insiders.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Using the tool, we searched for the Top German Smart Score Stocks and found two gems; Deutsche Telekom AG (DE:DTE) and Beiersdorf AG (DE:BEI). Let’s take a closer look at how these two companies have earned their “Perfect 10” smart scores on TipRanks.

Deutsche Telekom AG (DE:DTE)

The German telecommunications giant Deutsche Telekom AG is one of the largest telecom providers in Europe. Its operations are widespread across the U.S. and Europe. Also, it is the majority shareholder of American wireless network service provider T-Mobile US, Inc. (NASDAQ:TMUS). Year to date, Deutsche Telekom stock has gained 22%.

Is Deutsche Telekom a Good Stock?

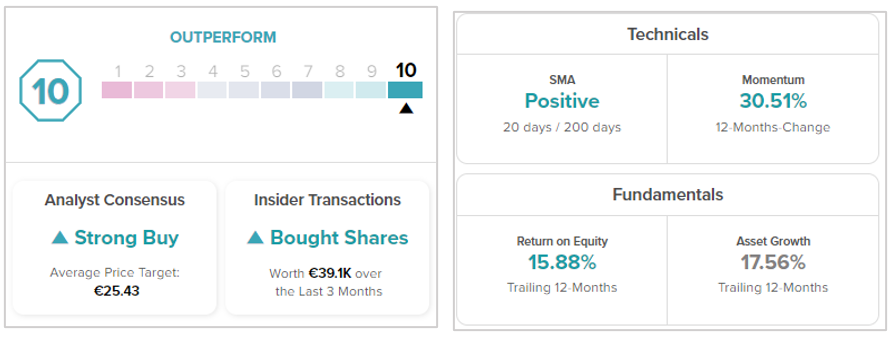

With 13 unanimous Buy ratings, DTE stock commands a Strong Buy consensus rating. On TipRanks, the average Deutsche Telekom price forecast of €25.43 implies 30.4% upside potential to current levels.

Additionally, corporate insiders have a Positive confidence signal on DTE stock, as two insiders have bought shares worth €39.1K in the last 3 months.

Further, Deutsche Telekom pays an annual dividend of €0.7 per share, reflecting a current yield of 3.26%.

Beiersdorf AG (DE:BEI)

A German multinational company, Beiersdorf AG, engages in two primary businesses; personal care products and self-adhesive product solutions. Beiersdorf is the owner of some of the most loved brands, including Nivea, La Prairie, Hansaplast, and Florena. The company is majority-owned by the privately run holding company Maxingvest AG. DEI stock has gained 14.9% so far this year.

Is Beiersdorf Stock a Buy, Sell, or Hold?

On TipRanks, Beiersdorf stock has a Moderate Buy consensus rating. This is based on 11 Buys, three Holds, and four Sell ratings during the past three months. Also, the average Beiersdorf price target of €106.41 implies that the stock is fully valued at current levels. Meanwhile, the highest analyst price target of €122 implies 15.5% upside potential from current levels.

Furthermore, corporate insiders are optimistic about BEI’s stock trajectory and have bought shares worth €47.8K in the past three months. Beiersdorf also pays an annual dividend of €0.7 per share, reflecting a modest yield of 0.67%.

Ending Thoughts

Investors often look for safe-haven stocks during uncertain macroeconomic times to protect their investments from possible losses. TipRanks Smart Score stocks could be one of the best possible tools to filter and select stocks as per your sector-specific inclinations and risk-bearing appetite.

The above two German stocks pay consistent dividends and have proven to be steadfast during difficult times. Also, their “Perfect 10” score means that both companies are highly likely to outperform market expectations, accompanied by stock price appreciation, adding a much-needed boost to an investor’s portfolio.