The Russian invasion of Ukraine sent shock waves all across Europe and hit the countries’ economies. Spain’s financial markets are currently dealing with rising inflation, tighter financial conditions, and an uncertain future. The inflation rate of 10.2% in Spain crossed the mark of 10% for the first time after 1985, which forced the ECB (European Central Bank) to increase rates after a decade.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Today, we have picked up two financial players, CaixaBank SA (ES:CABK) and insurance provider Mapfre, SA (ES:MAP), to discuss how these economic conditions are affecting their businesses and profitability.

CaixaBank SA

CaixaBank is a Spanish bank with around 4,500 branches, providing retail, business, premier, and international banking services.

CaixaBank is also one of the banks in Europe that benefited from the rising interest rate wave. This was reflected in the share prices, which jumped by a massive 65% in the last year.

Being one of the largest lenders in Spain, its profitability is largely related to interest rate movements. For the first nine months of 2022, the net interest income showed an increase of almost 10% at €4.8 billion. As per the current situation of rates, the bank would generate a higher net interest income of an additional €2 billion over the next three years.

The management approved a strategic plan for the bank to achieve certain financial targets by 2024. The new plan is customer-centric and focuses on efficiency and sustainability. The targets under this plan are to increase ROTE from 8.4% currently to over 12% by 2024. The cost-to-income ratio is expected to fall to 48% from 55% currently.

A slight reduction in bank activity levels remains a threat, which could reduce the fee income. The bank expects a 3% growth in its fees annually for the next three years.

Is CaixaBank a Buy?

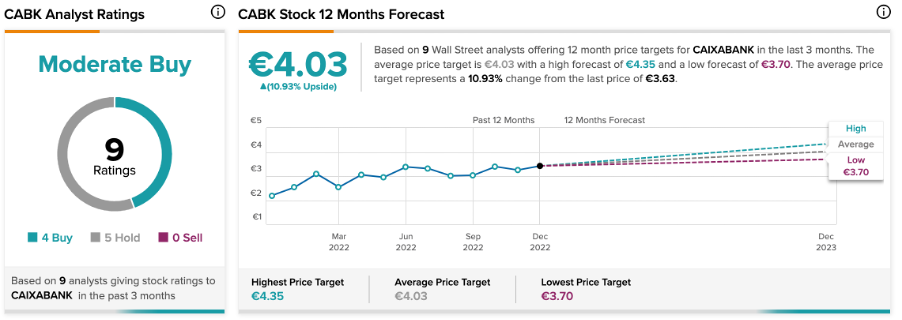

According to TipRanks’ analyst consensus, CaixaBank stock has a Moderate Buy rating. The CABK average target price is €4.03, which shows a growth of 11% on the current price level.

Mapfre, S.A.

Mapfre, the leading insurance player in Spain, had a good run in its share price with a 12% gain in the last three months. Overall, the stock has been trading down by 10% in the last three years.

The company’s third-quarter results exceeded analyst expectations, and it saw strong growth in its insurance operations in the majority of its locations. For the first nine months of 2022, Mapfre’s revenues increased by more than 10%, and the total premiums grew by 12.1%. However, higher business expenses dragged the earnings down to €488 million, down by 7% in this period.

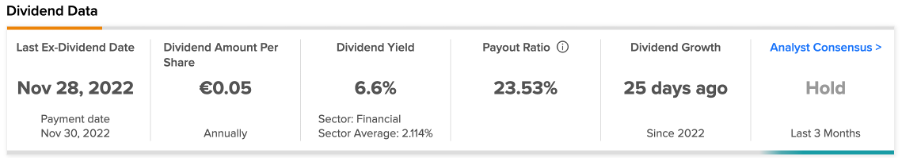

For income investors, Mapfre stock is a safe bet. The company has a dividend payment history of around ten years and a current dividend yield of 6.6%.

Mapfre Stock Forecast

As per TipRanks’ rating system, Mapfre stock has a Hold rating based on one Buy, one Hold, and two Sell recommendations.

The average target price for the stock is €2.0, which is 9% above the current price level.

Final Thoughts

Spanish banks are totally aware of the hurdles in front of them, but they still have not felt any major impact on their profits. CaixaBank is in the same boat and has proven its ability to withstand such tougher conditions.

Mapfre, on the other side, also enjoys a dominant position in the industry, which keeps the top-line growth intact. Also, the dividend yield makes it an attractive bet for investors.