Beleaguered fashion retailer Superdry plc (GB:SDRY) is making desperate attempts to survive. On Monday, SDRY confirmed a Sky News report that the company, along with its advisors at PricewaterhouseCoopers, is mulling a “radical restructuring” that could include a significant number of store closures and layoffs, given a dismal sales backdrop.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Superdry’s Efforts to Stay Afloat

Superdry did not provide details about its restructuring plans but stated that it is working with advisors to “explore the feasibility of various material cost saving options.” The retailer added that it continues to prioritize cost reduction and aims to deliver more than £40 million in savings in Fiscal 2024, ahead of its initial target of £35 million.

Last week, the company announced its results for the first half of Fiscal 2024 (26 weeks ended October 28, 2023) and disclosed that it has already achieved over £20 million of its targeted cost savings.

Superdry’s saving efforts come amid persistent weakness in its performance. In the first half of FY24, the retailer’s revenue declined 23.5% year-over-year to £219.8 million. Adjusted pre-tax loss widened to £25.3 million compared to £13.6 million in the comparable period of the prior year. The company blamed a tough retail market, an unfavourable weather, and weakness in its Wholesale segment for its disappointing performance.

Superdry has been hit by multiple headwinds in recent years, including abrupt senior management changes, the COVID-19 pandemic, a cost-of-living crisis that impacted the affordability of the company’s premium products, and a cash crunch. The company has cautioned investors that it does not expect market conditions to improve in the near term.

What is the Target Price for Superdry Shares?

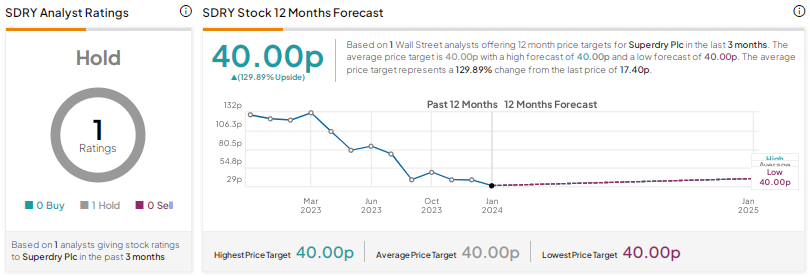

Superdry stock has a Hold consensus rating based on RBC Capital analyst Manjari Dhar’s recommendation. Dhar’s price target of 40p implies nearly 130% upside potential. The Superdry share price has plunged about 87% in the past year.