The ASX-listed BHP Group Limited (AU:BHP) yesterday announced the departure of its CFO, David Lamont, as the company undergoes significant leadership changes. Lamont will be replaced by chief commercial officer Vandita Pant, who will assume the CFO role in March 2024.

BHP is a renowned multinational mining company involved in the extraction and production of diverse commodities, including iron ore, coal, copper, nickel, and a variety of other minerals.

Executive Changes

Pant has been with the company since 2016 in multiple roles. Before joining BHP, she held positions with ABN Amro Bank and the Royal Bank of Scotland and possesses extensive banking experience. Lamont will continue his association with BHP until February 2025, taking on an “advisory and projects” role.

Meanwhile, Rag Udd, President Americas, will succeed Pant as the chief commercial officer. Brandon Craig, BHP’s asset president of Western Australia Iron Ore, will take up the position of President Americas.

BHP also said that chief technical officer Laura Tyler will leave the company in February. She will be succeeded by chief development officer Johan van Jaarsveld.

Strategic Business Overhaul

Over recent years, BHP has undertaken a significant overhaul of its business strategy, placing bets on commodities associated with decarbonization and electrification. The company is also trying to reduce its dependence on fossil fuels and focus on new-age metals like copper and nickel and fertilizer ingredient potash.

While the company’s annual results for 2023 reflected a decline in profits mainly due to lower average realized prices of its key commodities, the company is optimistic about the road ahead. It anticipates the demand for steel, non-ferrous metals, and fertilizers to grow in the long term, driven by population growth, improving living standards, and infrastructure development.

BHP Share Price Forecast

The BHP share price ended today at a gain of 0.40%. The stock has experienced huge volatility so far in 2023 owing to prices of commodities.

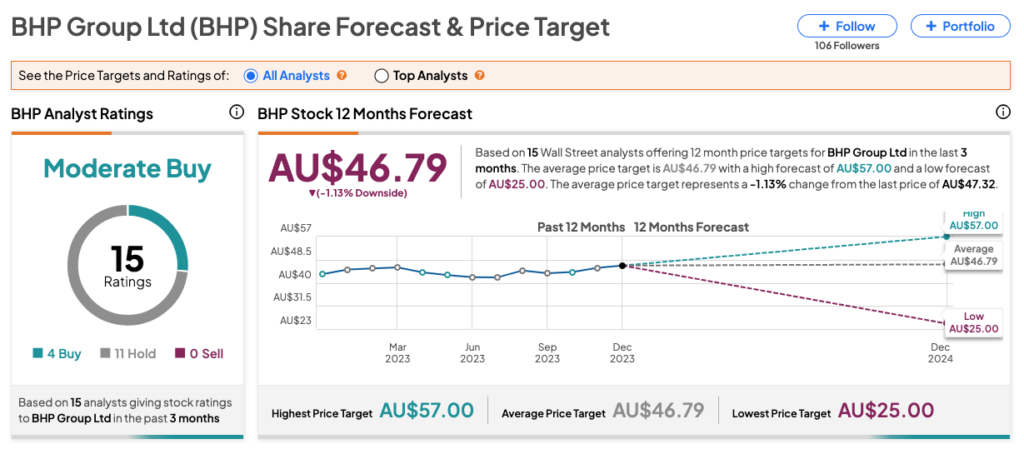

According to TipRanks’ consensus, BHP stock has been assigned a Moderate Buy rating, backed by 11 Hold and four Buy recommendations. Currently, the stock doesn’t offer any upside, with its outlook heavily dependent on commodity demand and prices. The BHP share price target is AU$46.79, which is 1.13% lower than the current trading price.