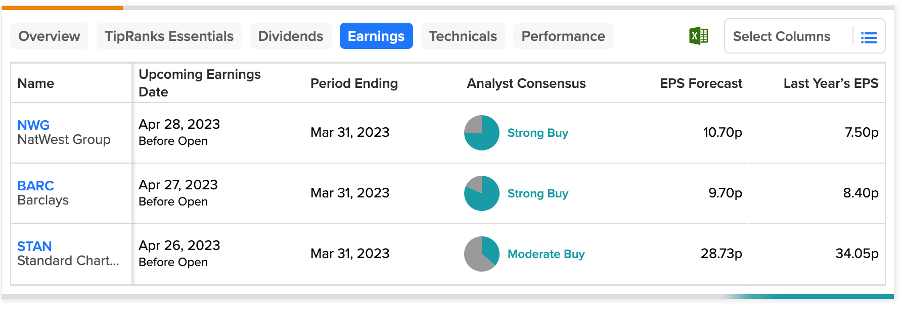

This week will mark the beginning of the 2023 earnings season for the major UK banks. Three of the big four banks, Standard Chartered (GB:STAN), Barclays (GB:BARC), and NatWest (GB:NWG), will announce their Q1 2023 earnings this week.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

After the banking sector went through major turmoil in March 2023, these giants have seen some stability in their share prices. However, now that the investors’ focus is back on the upcoming results, they will be eager to see how the banks are strengthening their balance sheets.

Let’s have a look at the details.

Standard Chartered PLC

Standard Chartered will start this earnings season and report its first-quarter earnings for 2023 on April 26. According to TipRanks analysts’ consensus, the forecasted EPS is 0.29p, lower than the EPS of 0.34p of the same quarter last year. The bank is expected to post a pre-tax profit of £1.4 billion, down from £1.5 billion in the last year.

Analysts believe the recent opening of the Chinese economy will help the bank boost its earnings, considering its higher focus on Asian markets.

Ahead of the results, Berenberg Bank’s analyst Peter Richardson has maintained his Buy rating on the stock. His price target of 1,000p indicates an upside of 62% on the current share price.

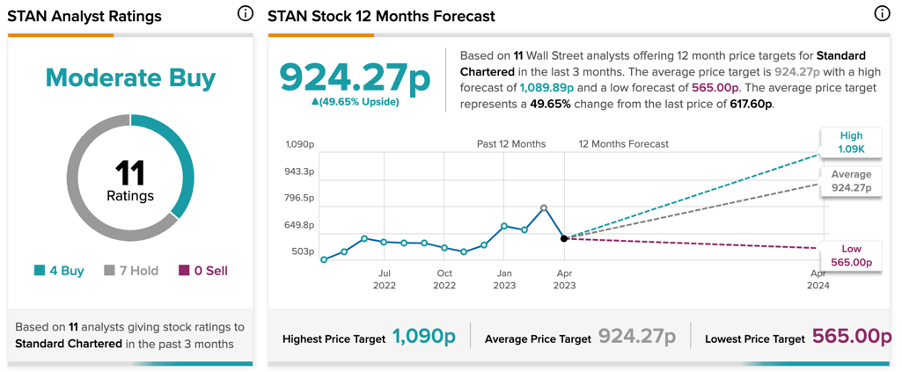

What is Standard Chartered Price Target?

STAN stock has a Moderate Buy rating on TipRanks, based on four Buy versus seven Hold recommendations.

The average price prediction for the stock is 924.27p, which has an upside of almost 50% from the current price.

Barclays PLC

The next in line after Standard Chartered is Barclays, which will announce its first-quarter results on Thursday, April 27. According to TipRanks consensus, the forecasted EPS for Q1 is 0.1p.

Analysts expect Barclays to post a 3.5% increase in its pre-tax profits of £2.3 billion. Some analysts also forecast profits to be flat for this quarter due to its performance in its investment banking segment. This could be an important point of discussion based on Barclays’ results this season. However, higher interest rates in the UK and trading revenues could offset the decline in investment banking.

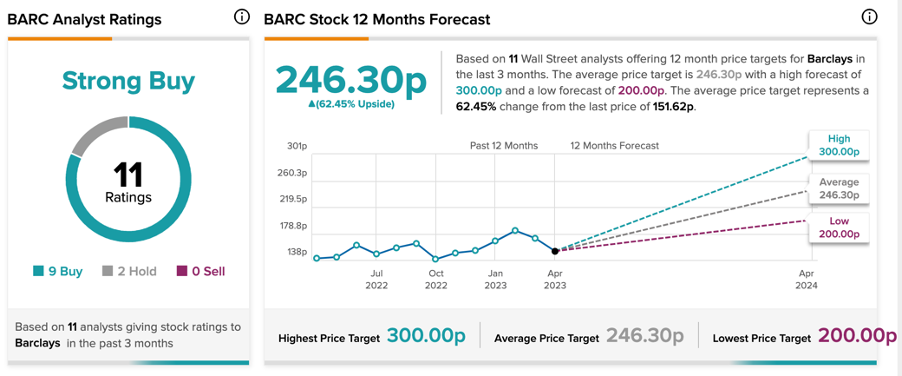

What is Barclays Stock Target?

BARC stock has a Strong Buy rating on TipRanks based on nine Buy versus two Hold recommendations.

With an average price target of 246.3p, analysts predict growth of more than 60% in the share price.

NatWest Group PLC

Following these two banks, NatWest will report its Q1 2023 results on April 28. According to TipRanks, the forecasted EPS for the quarter is 0.11p.

NatWest is expected to record a jump of 21.7% in its pre-tax profits of £1.51 billion on a year-over-year basis. The bank is also expected to report higher impairment losses of £250 million as compared to £144 million in the previous year.

Analysts expect that NatWest will benefit from its large mortgage base and rising interest rates in the quarter. Analysts are also bullish on NatWest’s net interest income, which is expected to grow by 46% on a year-over-year basis.

Is NatWest a Good Share to Buy?

According to TipRanks’ rating consensus, NWG stock has a Strong Buy rating, with nine Buy and three Hold recommendations. The forecast for the stock is 370.5p, which suggests a growth of 38.09% on the current price level.

Conclusion

UK banks’ earnings are one of the major focus areas for investors after the sector went through chaos this quarter. All three banks have favorable ratings from analysts ahead of their results and good upside potential in their share prices.

In terms of results, analysts expect NatWest to post a higher jump in its profits, driven by higher interest income and its strong mortgage portfolio.