The share price of Industria de Diseño Textil, S.A., or Inditex (ES:ITX) declined by around 4% today despite the company reporting record profits for the first half of FY23. Profits of €2.51 billion in the first half surpassed the market forecast of €2.38 billion and were also 40% higher than €1.79 billion posted in H1 2022. The company achieved favorable results in all geographical regions and across both online and offline sales channels.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Following the release of the results, ITX shares were trading 3.3% lower today at the time of writing. Investors opted to book profits given the strong performance of the company’s stock in the last 12 months, registering a gain of 62%.

Inditex is a leading Spanish retail company with a global presence in over 200 markets. The company boasts a diverse portfolio of brands, including Zara, Pull & Bear, Massimo Dutti, and more.

Half-Year 2023 Results

In the first half that ended on July 31, 2023, the company’s sales increased by 13.5% to €16.9 billion, driven by its spring/summer clothing line. Inditex’s gross profit grew 14.1% to €9.8 billion. The company’s strategy of sourcing its fashion line through local suppliers allowed it to successfully navigate inflationary pressures while limiting the extent of price increases. This led to the company’s gross margin reaching 58.2%, which was 27 basis points above H1 2022 levels.

Coming to the outlook, the company remains positive and expects higher sales productivity in its stores. The company’s autumn/winter collection has garnered positive feedback, resulting in a 14% growth (on a constant currency basis) in online and offline sales from August 1 to September 11, 2023.

Analysts’ Reactions

After the results, four analysts expressed their bullish outlook on the stock and confirmed their Buy ratings. However, the share price growth upside remains modest as the stock is already trading at higher levels.

Today, analyst Georgina Johanan from J.P. Morgan reiterated a Buy rating on the stock, suggesting an increase of 16%. Jefferies analyst James Grzinic predicted similar growth while maintaining his Buy recommendation.

Similarly, RBC Capital analyst Richard Chamberlain recommended buying the stock, projecting a more conservative upside potential of 7.4%.

Meanwhile, Adam Cochrane from Deutsche Bank reiterated a Hold rating on the stock.

Is Inditex a Buy?

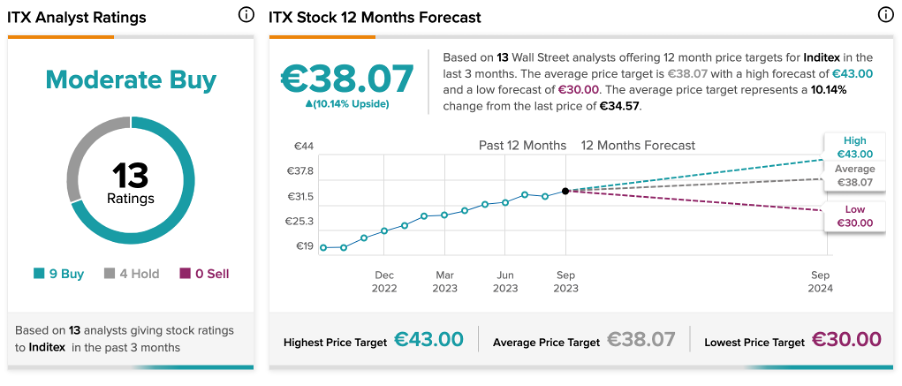

As per the consensus among analysts on TipRanks, ITX stock has been assigned a Moderate Buy rating. The company’s ratings consist of 13 evaluations, including nine Buy and four Hold recommendations.

The Inditex share price target is €38.07, which signifies a potential change of 10.1% from the current share price.