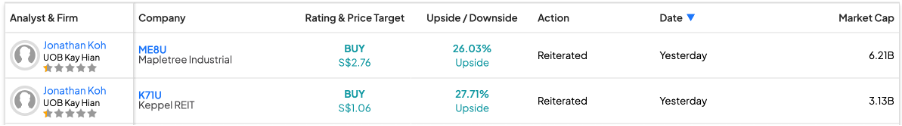

The brokerage firm UOB Kay Hian expressed its bullish views on the SGX-listed companies Mapletree Industrial Trust (SG:ME8U) and Keppel REIT Management Limited (SG:K71U) yesterday. Analyst Jonathan Koh from UOB Kay Hian has confirmed his Buy ratings for these two REITs.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Koh has maintained his Buy rating on MIT stock and increased the price target from S$2.74 to S$2.76. This implies a growth of 26% in the share price. He also confirmed his Buy rating on Keppel REIT’s stock but has reduced the price target from S$1.08 to S$1.06, predicting an increase of 27%.

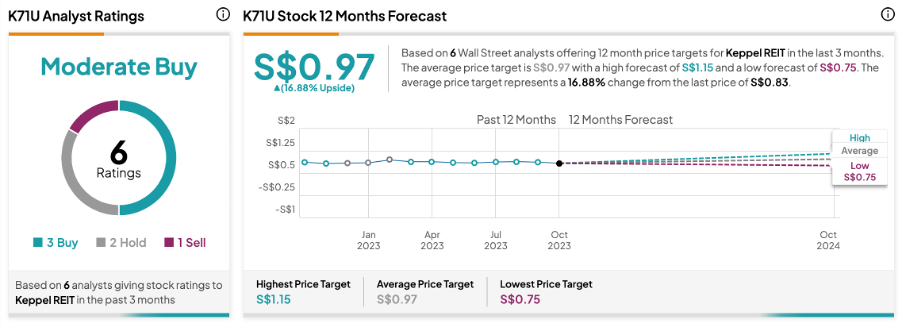

Overall, Keppel REIT has received a Moderate Buy rating and offers an upside of 16.8%, while Mapletree Industrial has been assigned a Strong Buy rating from analysts with similar growth potential.

Let’s have a look at these stocks in detail.

Mapletree Industrial Trust (MIT)

MIT is a Singapore-based real estate investment trust specializing in a diverse portfolio of industrial assets.

Koh’s recent rating was mainly driven by the company’s acquisition of a data center in Japan. He believes that with this move, the company has diversified its base in the Japanese market. The data center, with a net property income yield of 4%, is expected to contribute positively to the pro forma FY23 distribution per unit by 2.1%. The company is also further exploring options for more such assets in Japan. It is also divesting assets in Singapore to fund these acquisitions.

Koh stated that with this expansion strategy, the company is positioning itself to become a “pure play on data centers.”

Is Mapletree Industrial Trust a Good Buy?

According to TipRanks, ME8U stock has received a Strong Buy rating based on three Buy and one Hold recommendations from analysts. The Mapletree Industrial share price forecast is S$2.56, which implies a growth rate of 16.6%.

Keppel REIT

Keppel REIT is a leading real estate investment trust in Asia with a diverse portfolio that includes premium commercial properties across the Asian region.

Koh expresses optimism about Keppel REIT’s stock, noting the recovery in its Sydney portfolio and the stable performance of its Singapore assets. He believes that with a reduced hybrid work culture, the company is well-positioned to fill its office spaces in Sydney.

Additionally, Keppel REIT has allocated $100 million from accumulated capital gains to be distributed to unitholders over five years to commemorate its 20th anniversary in 2026. The distributions started in 2H22 and will continue until 1H27 at a rate of $10 million each time.

What is the Forecast for Keppel REIT?

According to TipRanks’ analyst consensus, K71U stock has received a Moderate Buy rating based on a total of six recommendations. It includes three Buy, two Hold, and one Sell ratings from analysts. The Keppel REIT share price target is S$0.97, which is 16.8% higher than the current price.