ST Engineering (SG:S63) and Singapore Post (SG:S08) are some of the old names in Singapore’s stock market. These companies have been part of some of the investors’ portfolios for a long time now.

On TipRanks, S63 stock has a Strong Buy rating, while analysts recommend a Hold rating for S08 stock.

Here, we have used the TipRanks Stock Comparison tool for the Singapore market to screen these stocks with various parameters.

Let’s discuss these stocks in detail.

Singapore Technologies Engineering (ST Engineering)

Based in Singapore, ST Engineering is a technology, defense, and engineering company catering to a broad range of sectors such as aerospace, smart cities, public security, etc. The company’s diverse operations in terms of industries and geographies make it a strong player in industrial stocks.

Financial services company Morningstar has rated the stock as 4 out of 5, based on its earnings growth potential now that the COVID-19 impact has subsided. Morningstar has forecasted a CAGR of 12.3% for the company’s earnings per share for the next five years.

Another bullish aspect for the company is its strong order book of $23 billion, which signals positive top-line growth. The company is targeting towards achieving a revenue goal of S$11 billion by 2026. Also, the company’s strategy to divest its non-core business units to focus more on its key areas like aircraft maintenance is the right step towards achieving its revenue goal.

ST Engineering Share Price Target

The stock has been trading up by more than 8% YTD.

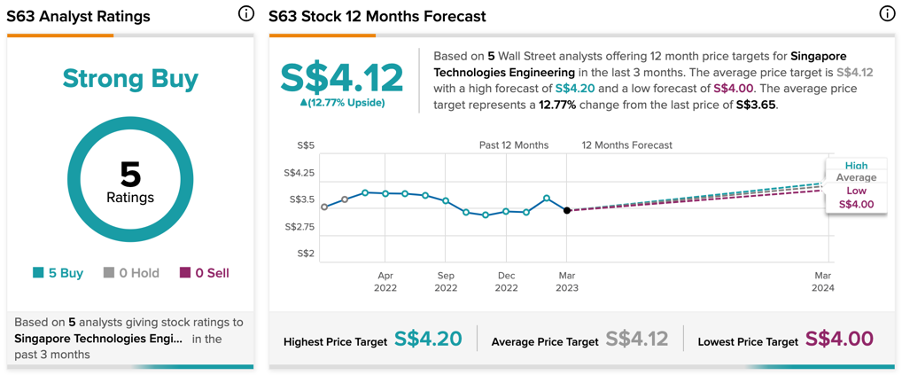

According to TipRanks’ analyst consensus, S63 stock has a Strong Buy rating based on all five Buy recommendations.

The average price target is S$4.12, which is 12.7% higher than the current price.

Singapore Post Limited (SingPost)

SingPost is the national postal service company in Singapore, which delivers mail, parcels, and express postal.

The SingPost stock has been trading down by around 33% in the last year. Even though the company has a well-established position in the postal service, this industry is going through a structural decline, which has impacted its revenues. However, the company’s transition towards logistics and overseas markets is a new ray of hope for investors.

In its third-quarter update for the fiscal year 2023, the company’s revenues increased by 13.4%, with growth in logistics offsetting the downfall in the post and parcel segments. The company’s performance was hit by higher operating expenses, which increased by 15.3% on a year-over-year basis. The operating profit was also down 9.7% as compared to last year but was 10% higher as compared to the previous quarter due to the seasonal growth.

Analysts feel that the worst could be over for its postal division, and the logistics division is all set for higher growth in revenues and operating profits. Analysts also believe dividend growth could be on the cards for the fiscal year 2024.

SingPost Share Price Target

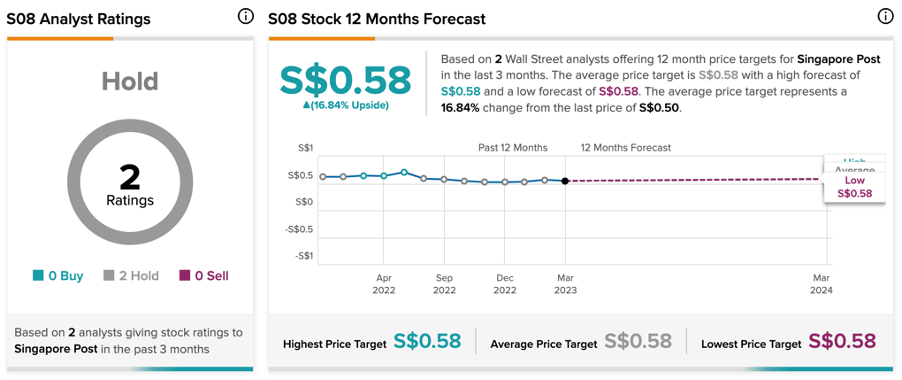

S08 stock has a Hold rating on TipRanks based on two Hold recommendations.

The average target price is S$0.58, which is 16.8% higher than the current price.

Conclusion

ST Engineering has strong bullish prospects backed by its order book value and the revival of global travel.

Investors in SingPost will have to wait a little longer as the company works to turn around its operations. This recovery will be gradual over the coming quarters.