SGX-listed OUE Commercial REIT (SG:TS0U) presents income investors with an attractive investment opportunity, boasting a substantial 7.3% dividend yield. OUE Commercial is among the largest REITs (real estate investment trusts) and has a diversified portfolio of assets in the hospitality and commercial segments. Talking of share price growth prospects, OUE Commercial offers a lucrative upside potential, as discussed below.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The Singapore market has always attracted income investors with its wide range of REITs. The mandate to distribute 90% of their income as dividends makes REITs a resilient and appealing choice.

TipRanks’ tools, like Top Singapore Dividend Stocks, come in handy to screen and select among the huge options of dividend-paying companies. Apart from Singapore, this tool is available in nine other markets on TipRanks, including Hong Kong, France, Australia, and more.

OUE Commercial REIT Dividend 2023

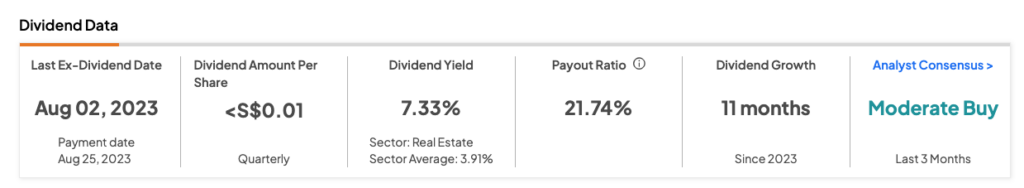

OUE Commercial pays its dividends on a semi-annual basis. In August 2023, the company paid S$0.0105 as its interim dividend for FY23, which was 2.8% lower on a year-over-year basis. The total dividend paid in 2022 was S$0.0212.

Like its peers, OUE is also facing headwinds from higher interest rates and finance costs, which are impacting its distributions. However, the company’s strong revenues and property income growth are mitigating the impact of these ongoing pressures to some extent.

In its third-quarter results for FY23, the company reported almost 30% growth in its net property income to S$62.7 million. The REIT’s average occupancy also stood strong at 95.7% by the end of September 2023. The favourable performance was driven by OUE’s hospitality assets amid the revival of tourism in Singapore. The company further benefits from having assets strategically situated in all key locations across the country.

OUE Commercial REIT Share Price Target

On TipRanks, TS0U stock has received a Moderate Buy rating based on one Buy recommendation from DBS analyst Rachel Tan. The OUE Commercial REIT share price target is S$0.35, which is 23% higher than current trading levels. The stock has been trading down by 16% year-to-date.