The share price of the UK-based Rolls-Royce Holdings PLC (GB:RR) gained over 3% after J.P. Morgan analyst David Perry upgraded his rating from Hold to Buy. He also increased his price target on the stock from 235p to 400p, now predicting an upside of almost 40%. The shares reached their highest level in over four years following this upgrade.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

J.P. Morgan has been bearish or neutral on Rolls-Royce stock since April 2018 due to the “higher long-term service agreement customer advances (LTSA) on its balance sheet.” The investment bank initially categorized these as debt, but now anticipates that a significantly higher percentage will be transformed into profits. This shift is attributed to the strategic changes recently unveiled by the company during its Capital Markets Day on November 28.

The changes include an increase in the rate of its LTSAs and an anticipated cost reduction of £400 to £500 million.

Rolls-Royce is a manufacturing company specializing in designing engines and power systems for the aerospace and defence industries. The company boasts a widespread global presence, with operations across the U.S., Asia, Europe, the Middle East, and Africa.

Share Price Momentum Continues

The upgrade sparked investors’ optimism, leading to a 3.4% gain at the time of writing today.

Last week, the stock reached a four-year peak, registering an almost 7% gain in one day’s trading. The surge was led by the company’s announcement detailing its strategies to enhance its profits and cash flow over the next four years.

Year-to-date, the stock has recorded a tremendous growth of around 190% in trading, positioning it prominently within the FTSE 100 index. This surge reflects the parallel growth observed in its sales and profits during 2023. Additionally, the revival of the aviation sector, coupled with its effective turnaround strategy, and the increase in global defence expenditures have played pivotal roles in achieving this growth.

Is Rolls-Royce a Good Stock to Buy Right Now?

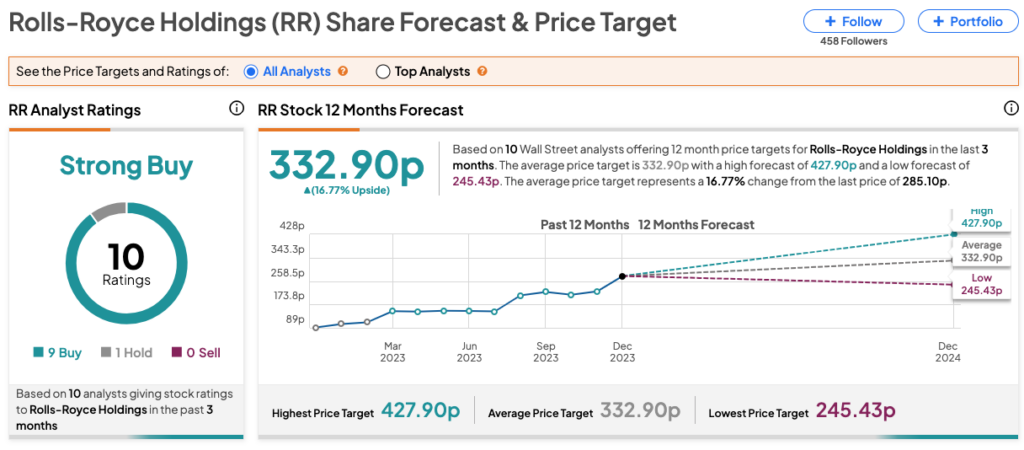

According to TipRanks, RR stock has received a Strong Buy rating based on nine Buys and one Hold recommendation. The Rolls-Royce share price forecast is about 333p, which is 16.8% higher than the current trading level.