Shares of British aerospace and defence company Rolls Royce (GB:RR) had a stellar 2023, rallying more than 220% due to the turnaround efforts under the leadership of CEO Tufan Erginbilgic. Despite such a significant rise, most analysts remain bullish on the stock, with Rolls Royce shares continuing to score a “Strong Buy” consensus rating.

Continued Optimism About Rolls Royce

Rolls Royce, which makes engines for aircraft that are mainly used for long-haul travel, was hardly hit by the COVID-19 pandemic. Rolls Royce incurred major losses, as the slump in travel due to the pandemic weighed on the company’s revenue, which is closely tied to the number of hours its engines are in use.

However, Rolls-Royce recovered strongly last year, fueled by its multi-year transformation programme. Under this plan, the company is exiting non-core businesses and focusing on improving its profitability through efficiency and cost reduction initiatives.

Rolls Royce’s impressive results for the first half of 2023 reflected the benefits of its turnaround plan. Notably, the company jumped to a pre-tax profit of £524 million in the first half of 2023 from a loss of £111 million in the comparable period of the prior year. The company has also been strengthening its balance sheet by reducing its debt. At the end of the first half of 2023, the company’s net debt stood at £2.85 billion, down from £3.25 billion as of December 31, 2022.

Looking ahead, Rolls Royce is positive about boosting its business across its Civil Aerospace, Defence, and Power Systems segments. Over the mid-term, the company is targeting operating profit of £2.5 billion to £2.8 billion, operating margin of 13% to 15%, and free cash flow of £2.8 billion to £3.1 billion.

What is the Stock Price Prediction for Rolls-Royce?

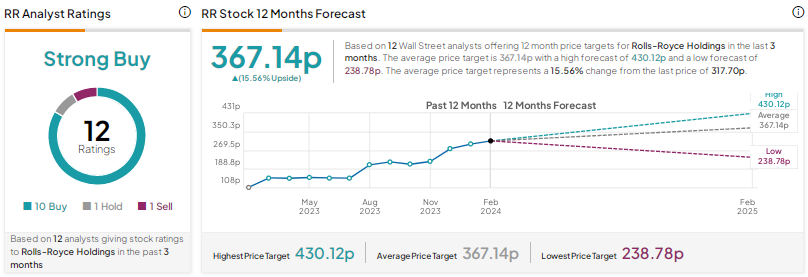

With 10 Buys, one Hold, and one Sell, RR stock earns a Strong Buy consensus rating. The average Rolls Royce share price target of 367.14p implies 15.6% upside potential.

Conclusion

Despite concerns about the near-term impact of macro headwinds, most analysts remain bullish on Rolls Royce’s long-term growth prospects. As per TipRanks’ Smart Score System, Rolls Royce scores a “Perfect 10,” implying the stock has the ability to outperform the broader market over the long term.