DAX-40-listed Rheinmetall AG’s (DE:RHM) shares have grown by 40% in the last six months. Recently, the company received confirmation of Buy ratings from analysts, indicating additional growth potential for the stock.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

With a presence in 33 countries globally, Rheinmetall is a prominent manufacturer and supplier of systems and equipment for various industries, including automotive, security, and civil sectors.

Let’s take a look at the new ratings for the stock.

New Ratings

Analysts are bullish on the long-term prospects of the company, as it is strategically positioned to assume a significant role as a prominent military supplier, not only for Germany but also for its allied nations.

Yesterday, Christoph Laskawi from Deutsche Bank reiterated his Buy rating at a price target of €275.0. This implies a growth of 7.46% in the share price.

Prior to that, two days ago, Warburg Research analyst Christian Cohrs confirmed his Buy rating on the stock, predicting an upside of 14% from the current trading level.

First-Quarter Earnings

Last month, the company reported its Q1 2023 earnings, which showed continuous operational momentum for the company. The company’s sales grew by 7.6% to €1.4 billion as compared to the same period last year. Rheinmetall’s order backlog increased from 8% to €28 billion during the quarter.

The company confirmed its existing projections for sales and operating margin for the current year. The Group maintains its sales growth forecast for 2023, ranging between €7.4 billion and €7.6 billion. Furthermore, the company expects an enhancement in operating earnings and aims for an operating margin of approximately 12%.

Is Rheinmetall a Good Stock to Buy?

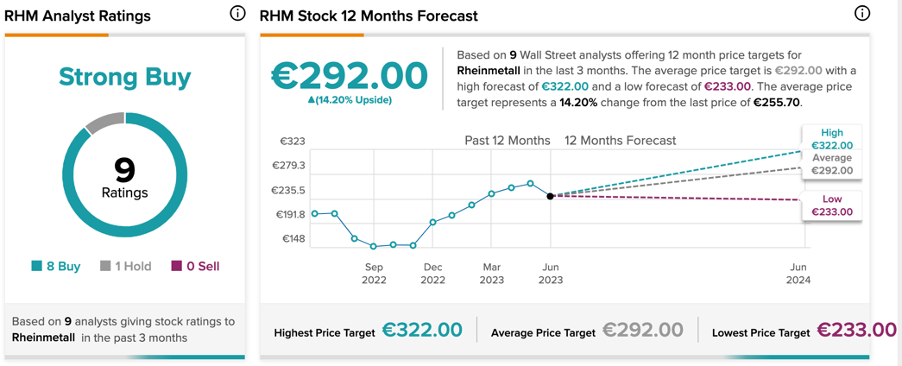

On TipRanks, RHM stock has a Strong Buy rating backed by nine Buy and one Hold recommendations.

The average stock forecast is €292.0, which shows an upside potential of 14.2%. The target price has a high forecast of €322 and a low forecast of €233.

Conclusion

Rheinmetall has demonstrated robust performance in its recent financial results and remains optimistic about its prospects for the remainder of 2023. The Strong Buy rating from analysts reinforces the investment case and strengthens its appeal further.