The latest inflation figures out of Australia are anything but reassuring for those dreaming of rate cuts and a stable moving AUD-USD. Despite the Reserve Bank of Australia’s (RBA) previous whispers about potential easing, the real numbers have burst that bubble. And the odds are there might not be a lowering of rates this year after all.

In the first quarter of 2024, the Consumer Price Index (CPI) unexpectedly jumped to 1% quarter-over-quarter, outpacing the forecasted 0.8%. Annually, the CPI pushed up to 3.6%, nudging past expectations of 3.4%. Even more concerning, the trimmed mean CPI—a core measure that typically strips out volatile price movements—mirrored this uptick, climbing to a solid 1% over the quarter and 4% over the year, signaling that not all inflation pressures are fleeting.

Inflation Surpassed the RBA’s Own Forecasts

The RBA, cautiously optimistic about nudging inflation back towards its 2-3% target, might now have to holster its rate-cutting scissors. The figures not only came in hotter than expected but also managed to surpass the RBA’s own forecasts.

Here’s why the RBA might keep its rates on ice longer than its global peers:

- Sticky Inflation: Recent data confirm that high inflation isn’t ready to leave the party just yet. Though the lowest since the second half of 2022, both goods and services inflation figures remain uncomfortably high. The goods inflation stands at 3.1% year-over-year, while services inflation is at 4.3%.

- Economic Stimuli: Over the next few months, Australians can expect a concoction of economic sweeteners, from a notable rise in the minimum wage to generous income tax cuts. Additionally, the federal budget is likely to splurge in an effort to soften the blow of living costs. This mix could either stir the inflation pot further or give the RBA the breathing space it needs, depending on who you ask.

Westpac’s chief economist, Luci Ellis, formerly of the RBA, remarks on the situation: “Inflation was a bit higher than expected in the March quarter. It is declining, but it still has a way to go for the RBA to be confident of returning to the 2-3% target range on the desired timetable.“ As a result, Westpac now forecasts the RBA will maintain rates in May, delaying any potential rate cuts until November at the earliest. Westpac previously eyed cuts for September.

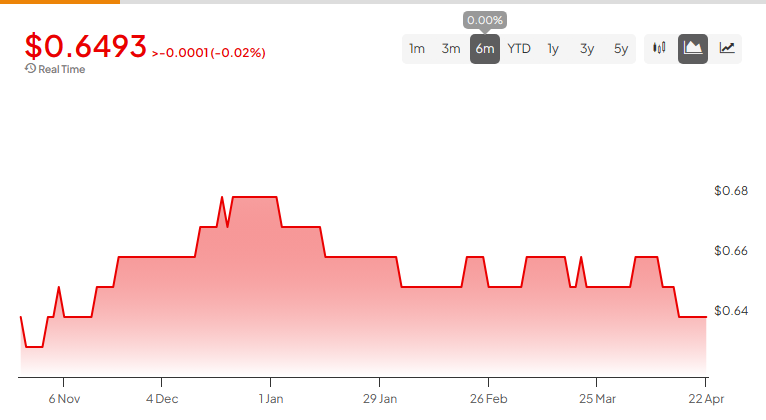

AUD-USD Leaps over 0.65 Level

As traders reacted to these revelations, the Australian dollar took a leap over 0.6500 to an intra-day high of 0.6529. However, any bullish fundamentals or technicals were ignored by traders as the AUD-USD moved into the New York lunch session. The AUD-USD has retraced all of those gains and is presently only two pips above (0.6489) its open of 0.6487.