Shares of German-based Encavis AG (DE:ECV) plunged 8.7% on December 11 after receiving a rating downgrade from an American investment bank, Morgan Stanley (NYSE:MS). Analyst Harrison Williams downgraded ECV stock to a Sell from a Hold while reviewing the utilities sector. Williams left the price target unchanged at €12.00, implying a 10.5% downside potential from current levels.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Encavis AG is an independent solar park operator. The company engages in the acquisition and operation of solar and onshore wind farms. In its nine months ending September 30, 2023 results, Encavis reported a flat year-over-year revenue growth and a 9% decline in EBITDA (earnings before interest tax depreciation and amortization). Meanwhile, production volume grew meaningfully, thanks to the acquisition of new wind and solar farms in 2022. Year-to-date, ECV shares have lost 27.3%.

Here’s the Analyst’s View on the Utilities Sector

Willams reviewed the utilities sector for 2024 and shared that the sector is most likely to outperform the broader market. The analyst’s bullish stance is backed by several tailwinds, including the sector’s defensive profile coupled with lucrative valuations, the possibility of increased earnings, political support, and the inverse relation with bond prices.

Williams noted that even if interest rates rise in 2024, the sector will do well because it is a defensive play. Despite the positive attributions, Encavis stock falls at the bottom of Williams’ list of favored companies. The analyst is particularly watchful of the expenses related to the multiple project takeovers that could hurt the company’s future performance.

Is Encavis AG a Good Stock to Buy?

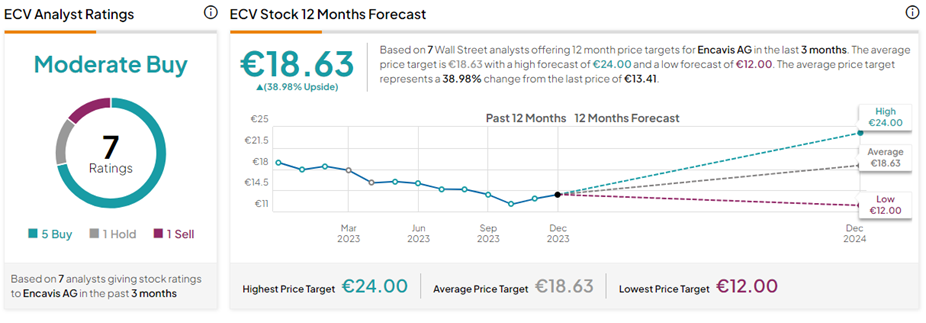

On TipRanks, ECV stock has a Moderate Buy consensus rating based on five Buys, one Hold, and one Sell rating. The Encavis AG share price forecast of €18.63 implies a nearly 39% upside potential from current levels.