ASX-listed companies QBE Insurance Group (AU:QBE) and Aristocrat Leisure Limited (AU:ALL) have been rated as Strong Buy by analysts.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Among these companies, QBE stands out with a notable upside potential of over 20% in its share price. On the other hand, Aristocrat presents a more modest growth prospect of 6% in its share price.

Now, let’s delve into some of the particulars.

QBE Insurance Group Limited

QBE is a global insurance and reinsurance company that operates in 27 countries. The company provides a wide range of insurance services, including personal, commercial, vehicle, home, and other offerings.

Recently, the stock got a lot of traction from analysts after the company updated its full-year guidance numbers. The company mentioned that it has started the year with premium growth and remains upbeat on future numbers. In the first quarter of fiscal 2023, the company reported robust growth in gross written premium, with an increase of 11% as compared to Q1 2022.

QBE has revised its outlook for the fiscal year 2023, now anticipating group gross written premium growth of approximately 10%, as opposed to the previous expectation of mid-to-high single digits.

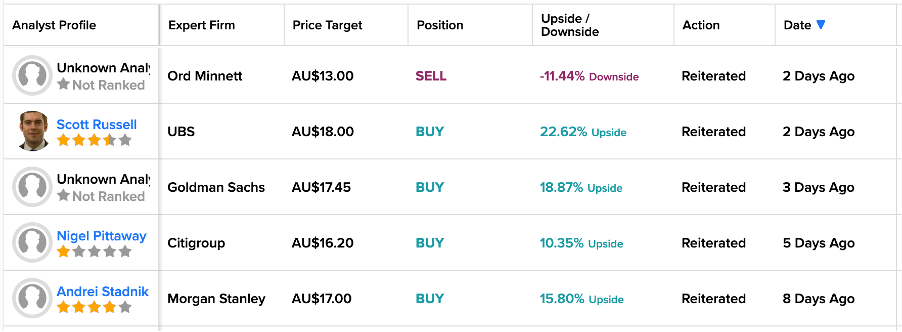

As a result, many analysts have confirmed their bullish ratings on the stock and are expecting better organic growth for the company in 2023. Two days ago, analyst Scott Russell from UBS reiterated his Buy rating on the stock and forecasted a growth rate of 22.6% in the share price. He reduced his price target from AU$18.5 to AU$18.

Contrary to this, Ord Minnett reiterated their Sell rating on the stock two days ago and expect a downside of 11.4% in the share price.

QBE Insurance Stock Price Target

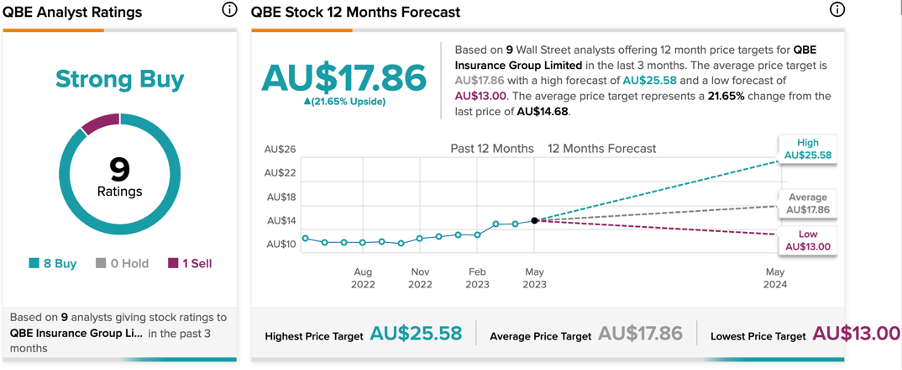

According to TipRanks’ consensus forecast, QBE stock has a Strong Buy rating, based on eight Buy versus one Sell recommendations.

At an average target price of AU$17.86, analysts suggest a growth of 21.65% on the current price.

Aristocrat Leisure Limited

Aristocrat Leisure is a technology company that specializes in the development of mobile and casino games, in addition to manufacturing gaming machines.

On Monday, the company announced its intention to acquire NeoGames SA (NASDQ:NGMS), an online gaming solutions provider based in Israel. Aristocrat intends to acquire all outstanding shares of NeoGames at a price of $29.50 per share. This offer represents a substantial premium of around 130% compared to NeoGames’ closing price of $12.84.

The acquisition will provide Aristocrat with an entry point into the iLottery market, which is known for its attractiveness and also for its high level of regulation. Additionally, the acquisition will enable the company to expand its presence in various other online real-money gaming (RMG) verticals.

Post-announcement, overall analysts remain bullish on the deal and also on the stock.

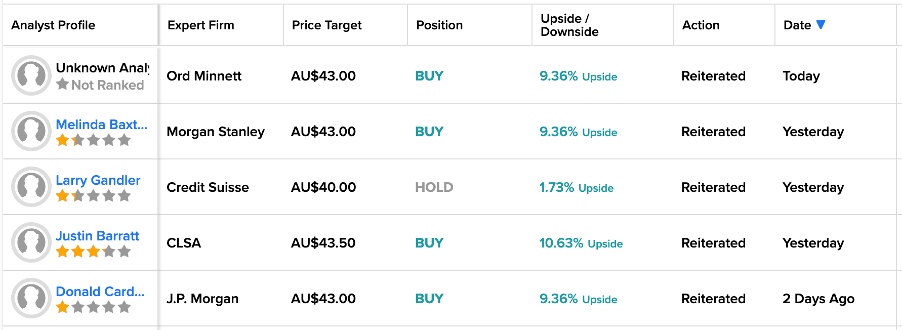

Today, analysts from Ord Minnett reiterated their Buy rating on the stock and expect an upside of 9.3% in the share price.

Yesterday, analysts from Morgan Stanley and CLSA also confirmed their Buy ratings and forecasted growth of 9.3% and 10.6%, respectively.

Is Aristocrat Leisure a Buy?

Based on eight Buy and on Hold recommendations, ALL stock has a Strong Buy rating on TipRanks. The average price forecast of AU$41.77 implies a change of 6.23% from the current price level.

YTD, the stock has been trading up by 28.41%.

Conclusion

These two ASX shares have gained positive sentiment from analysts, who anticipate further growth in their share prices. The updated guidance numbers from QBE and Aristocrat’s new acquisition deal have further boosted analysts’ confidence in these stocks.