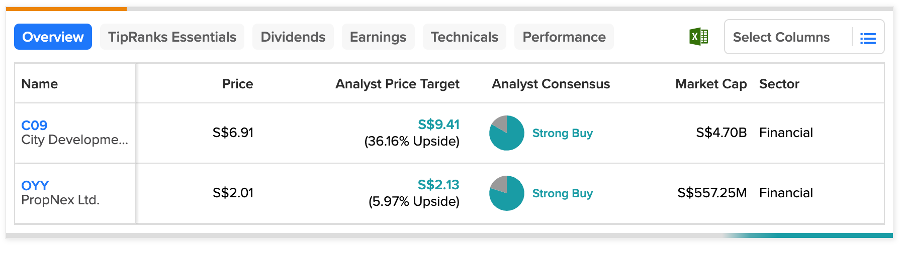

Using the TipRanks Database, we have identified two SGX-listed companies City Developments Ltd. (SG:C09) and PropNex Ltd. (SG:OYY that have received “Strong Buy” ratings.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Although analysts are optimistic about both stocks, City Developments is projected to have a greater potential for an increase in its share price, with a potential upside of over 35%, compared to PropNex’s potential upside of 6%.

Let’s see what makes them the preferred choices of analysts.

City Developments Limited (CDL)

City Developments is a Singapore-based real estate company that holds assets in 28 countries worldwide. The company possesses a varied portfolio that includes properties such as residential buildings, hotels, office spaces, malls, and more.

Since the start of 2023, the company’s stock has declined by 15.3%. Despite this, analysts remain optimistic about the company’s future prospects and consider it a favorable opportunity for investors to buy into the stock.

CDL reported robust sales of its development properties in 2022. The management anticipates that the property market will continue to be strong, even after the implementation of the government’s recent cooling measures, due to the limited supply of new properties available on the market. Moreover, the company’s office portfolio in Singapore is currently experiencing a high committed occupancy rate of 94.3% as of December 2022.

Analysts expect the company to post a strong performance in 2023, thanks to a promising development pipeline and a positive outlook for its investment properties and hotel division.

City Developments’ Share Price Target

According to TipRanks’ rating consensus, C09 stock has a Strong Buy rating based on five Buy versus one Hold recommendations.

The average target price is S$9.41, which suggests an upside potential of 36% from the current price level.

PropNex Limited

PropNex, headquartered in Singapore, is a prominent real estate brokerage and consulting firm that offers a comprehensive online real estate platform featuring an extensive collection of residential and commercial properties.

The company’s stock has garnered a positive outlook from analysts due to its improved market share, impressive growth figures, and robust financial position without any debt. However, the potential upside remains limited, as the stock has been trading up by more than 50% in the last six months.

However, the stock compensates for its lack of capital growth with higher dividend payments for investors. The stock has a current dividend yield of 5.9%, as compared to the sector average of 2.1%. Most recently, the company announced a dividend of S$0.08 per share, which will be payable on May 12.

What is the Target Price for PropNex?

Based on four Buy and one Hold recommendations, OYY stock has a Strong Buy rating on TipRanks. The average target price is S$2.13, which is 6% higher than the current trading price.

Conclusion

Amidst the unpredictable market, relying on analyst recommendations can make stock selection easier. The Strong Buy ratings of these two SGX stocks indicate they are relatively secure options.