musicMagpie PLC’s (GB:MMAG) stock surged today after it confirmed takeover talks from the telecom giant BT Group PLC (GB:BT.A) and European investment firm Aurelius. The company stated that it is in the preliminary stages of discussions and emphasized the uncertainty of either party presenting any offer.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Both potential suitors have to officially declare a concrete proposal for MusicMagpie or communicate their decision to quit the process by December 18.

musicMagpie is a British online retailer specializing in the purchase and sale of refurbished electronics. The company also resells a diverse range of products, spanning from phones to laptops, smartwatches, and game consoles.

The Rationale

Experts believe that BT and its mobile brand EE handle huge volumes of phones; therefore, the acquisition of a refurbishment business like musicMagpie seems like a strategic move. Recently, EE has announced its intention to broaden its product offerings, revealing plans to include kitchen appliances in its lineup starting next year.

Aurelius, the second contender for the potential acquisition of MusicMagpie, is possibly interested in the retail segment of the group.

Is It the End of Troubled Times?

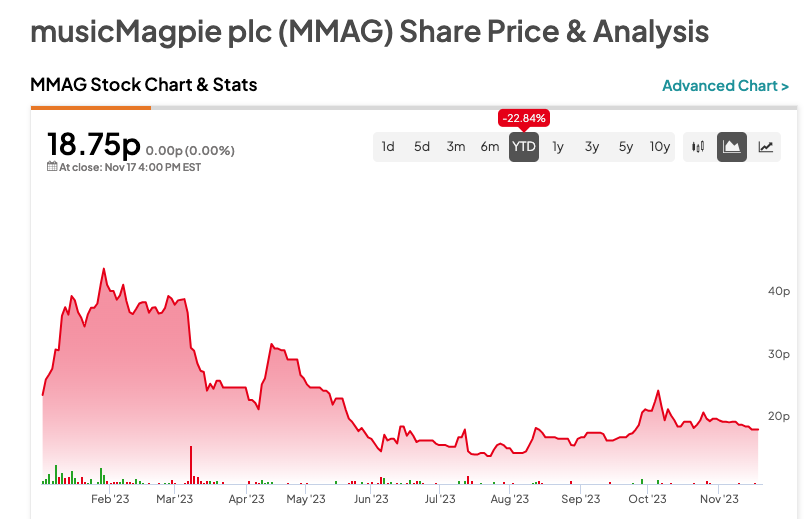

Since MusicMagpie went public on the London Stock Exchange two years ago, the company’s stock value has declined by approximately 87%. This downturn is attributed to the easing of COVID-related restrictions and increased economic uncertainty, resulting in a slowdown in trade.

The sales declined this year due to diminished consumer confidence in the UK and the repercussions of postal strikes earlier this year. In the first half of FY23, the company’s revenue was down to £61.9 million from £71.3 million a year ago. The company is also struggling to generate profits due to higher costs and increased competition on marketplaces like Amazon and eBay.

Following this news, the stock experienced a notable gain of around 24% yesterday, giving hope to investors for a potential turnaround. The stock has lost over 20% in trading so far in 2023.