UK-based Marks and Spencer PLC (GB:MKS) saw its profits soar in its first-half results, driving the share price higher. The company also announced an interim dividend of 1p per share after a four year absence, rewarding its shareholders for its “strong financial results.”

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The company reported a remarkable 75% increase in pre-tax profits for the first half, surpassing expectations by reaching £360.2 million. The pre-tax statutory profits increased to £326 million from the £208 million recorded in the corresponding period last year. This impressive performance is underpinned by a 14.7% growth in Food sales and a 5.7% increase in clothing and home sales.

Marks and Spencer is a well-established British retailer, serving a diverse customer base. The company is known for its comprehensive offerings, which include Clothing, Food, and Household Goods.

“Reshaping M&S” Strategy Paid Off Well

The company’s “reshaping M&S” strategy for growth has yielded robust outcomes in the first half. The company has continued its commitment of providing customers with trusted value, offering top-notch products at the most competitive prices.

In its Food division, M&S introduced more than 500 quality improvements and allocated over £30 million towards price reductions, resulting in lower prices for 200 products and price stability for 150 customer-favorite items. In Clothing & Home, the company focused on enhancing its product lines and more styling options. Consequently, the company sold more products across these categories, surpassing the overall market.

Is Marks and Spencer a Good Stock to Buy?

Investors cheered the strong numbers and dividend news, sending the shares up by over 10% at the time of writing today. Year-to-date, the stock has delivered a huge return of 95% in trading.

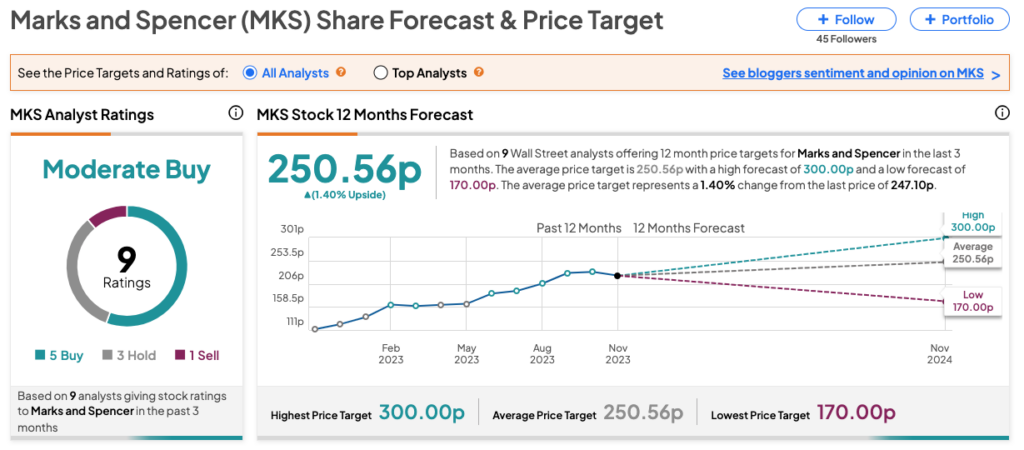

The M&S share price prediction for the 12-month period is 250.56p, which is 1.4% above the current trading levels. On TipRanks, MKS stock has received a Moderate Buy consensus rating among analysts, including five Buy, three Hold, and one Sell recommendations.