The share price of the FTSE 250-listed Mobico Group (GB:MCG) witnessed a sharp drop after the company cut its annual profit outlook and canceled its final dividend for FY23. In its Q3 trading update, the company stated the recovery in its profitability is taking longer than expected, and the earnings are now expected within the range of £175 million to £185 million. This marks a decrease from the guidance provided in July, which projected a range between £200 million and £215 million.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

The stock went down by 28% on Thursday following the announcement, contributing to a year-to-date loss of 32%.

Mobico Group is a transportation company that provides bus, train, and other coach services. The company operates in around 11 countries worldwide.

Difficult Route Ahead

The company faced severe challenges during the pandemic with travel restrictions, but its performance rebounded. However, currently, the company is struggling with high-cost inflation and low profitability, especially after the COVID-19 funding was reduced. As a result, the company has agreed to divest its school bus business in North America as part of its effort to reduce its debt and improve profitability.

The company posted a 10% growth in its revenues, with UK revenues up by 13%, while Germany posted a decline of 3%. Revenues from North America increased by 4% in Q3. Despite decent growth in revenues, profits were impacted mainly due to higher costs. As announced earlier, the company is on track to achieve £30 million in annualized savings and £15 million this year.

What is the Stock Price Forecast for Mobico Group?

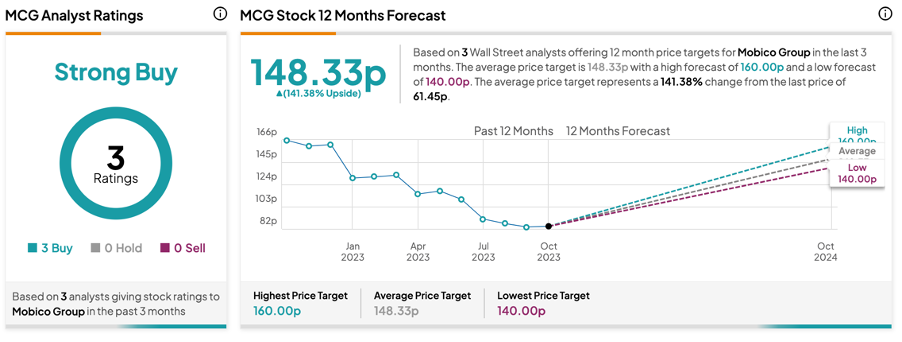

According to TipRanks, MCG Stock has been assigned a Strong Buy rating, backed by all Buy recommendations from three analysts. The Mobico share price forecast is 148.3p, which implies a solid upside of 141.38% in the share price.