UK-based M&G PLC (GB:MNG) and Phoenix Group Holdings (GB:PHNX) stand out as leading companies on the FTSE 100 index, offering high dividend yields. Both companies offer dividend yields above 9%. In terms of capital growth, M&G stock has a Hold rating from analysts, while Phoenix carries a Moderate Buy rating.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

TipRanks offers a variety of tools to help users choose dividend stocks that meet their criteria. These tools, such as the Dividend Calculator, Dividend Stocks, Stocks Comparison, etc., streamline the process of screening and selecting stocks within specific markets.

Let’s dig deeper into some details.

What is the Dividend Forecast for M&G?

M&G functions as a savings and investment company, providing a wide array of solutions for long-term savings, investments, and asset management.

M&G offers a dividend yield of 9.72%, surpassing the industry average of 2.114%. In 2022, the company distributed a total dividend of 19.6p per share, and this figure is projected to rise to 19.7p in 2023. Furthermore, the dividends are anticipated to further increase to 19.87p in 2024.

As the dividend yield comes close to 10%, the company intends to bolster its asset management and wealth divisions to drive more than 50% of the total profits from them. Additionally, the company’s solid financial position makes the dividend story more attractive.

Is M&G a Good Share to Buy?

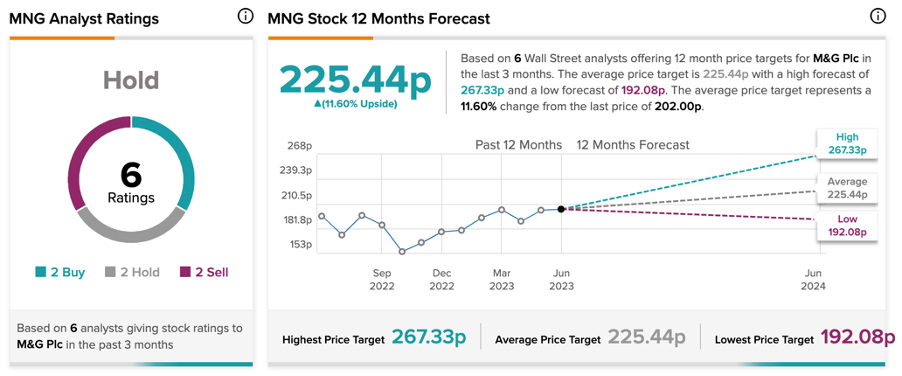

MNG stock has a Hold consensus rating on TipRanks, based on two Hold, two Buy, and two Sell recommendations.

At an average price target of 225.4p, the stock has an upside potential of 11.6% on the current trading levels.

Phoenix Dividend Yield

Phoenix Groups is a financial services company offering insurance, savings, and retirement solutions. The company owns the largest savings and retirement business in the UK.

The company carries the second-highest yield among the companies listed on the FTSE 100, surpassing only M&G. The company’s dividend yield of 9.04% makes it a good investment option.

In its 2022 annual results, the company demonstrated strong operational performance along with a 5% dividend hike. The total dividend for 2022 was 50.8p per share, as compared to 48.9p paid in 2021. The company posted a jump of £0.3 billion in its long-term free cash to £12.1 billion in 2022, which guarantees the sustainability of its expanding dividend over the long term. Due to higher cash generation, analysts don’t expect any dividend cuts in the near future.

Are Phoenix Group Shares a Good Buy?

According to TipRanks’ analyst consensus, PHNX stock has a Moderate Buy rating. The stock has a total of eight recommendations, of which five are Buy.

The average price prediction for the next 12 months is 686p, which implies an upside of 23% from the current level.

Conclusion

These companies from the UK could be the perfect addition for investors looking for solid passive income from their portfolios.