The ASX 200-listed shares of Megaport (AU:MP1) rallied about 28% on Tuesday, after the cloud network service provider reported stellar Q2 performance. The company’s revenue grew 31% year-over-year to AU$48.6 million in the second quarter of Fiscal 2024, which ended on December 31, 2023. Megaport shares touched a 52-week high of AU$12.83 today and have jumped nearly 120% in the past year.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Megaport’s Impressive Q2 FY24 Results

Megaport’s EBITDA (earnings before interest, taxes, depreciation, and amortization) increased significantly to AU$15.1 million from AU$2.4 million in the prior-year quarter. Moreover, the company ended the quarter with annual recurring revenue (ARR) of AU$191.7 million, reflecting about 30% year-over-year growth. Investors were also pleased as the company reported a positive net cash flow of AU$6.9 million compared to a negative net cash flow of AU$11.1 million in the prior-year quarter.

The company attributed its strong performance to the continued rise in recurring revenue, an increase in customers, and higher adoption of its services in all regions. In particular, the company’s customer base increased 7% year-over-year to 2,816.

Looking ahead, Megaport is optimistic about continued momentum, with its Global WAN (wide-area network) solutions gaining traction. The company also expects its business to benefit from aggressive investments in innovation and go-to-market strategies.

Is Megaport a Good Buy?

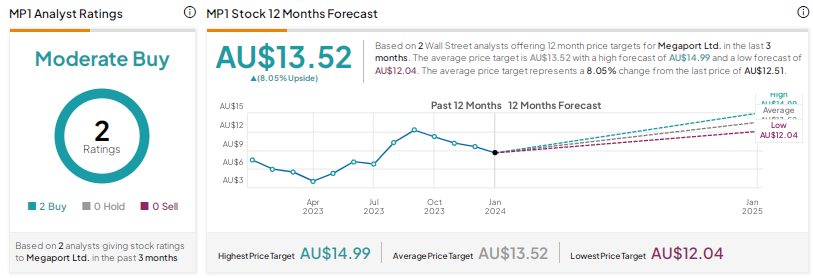

Analysts have a Moderate Buy consensus rating on MP1 stock based on two unanimous Buys. The Megaport Ltd. share price target of AU$13.52 implies 8.05% upside potential.