No matter what the business cycle in the economy is or what type of investor you are, good dividend-paying stocks are a must for every portfolio. Reinvesting the dividend income could lead to a multiple-fold increase in investors’ wealth due to the power of compounding.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

When choosing such stocks, it’s not only the dividend yield that matters but also the company’s earnings growth, cash flow situation, and net debt on the balance sheet.

Singapore-based companies Golden Agri-Resources (SG:E5H) and Singtel (SG:Z74) not only have higher dividend yields, but analysts also forecast more than 20% of share price growth.

We have selected these stocks from the TipRanks Top Singapore Dividend Stocks tool. With the help of this tool, investors can compare companies from Singapore on parameters like rating, target price, news sentiment, hedge fund signal, and more.

This tool gives a crisp view of all the required details and makes it easy for investors to pick their stocks.

Golden Agri-Resources (GAR)

With its product presence in around 100 countries worldwide, GAR is a leading company in palm oil production with end-to-end supply chain operations.

Last month, the company declared its third-quarter results, with some record-breaking performance. The earnings for the first nine months posted a jump of 62% year-on-year to $1.3 billion. Revenues grew by 18% to $8.6 billion. The lower sales volume was compensated by higher palm oil prices, which increased the net profit for the third quarter by 148% to $285 million.

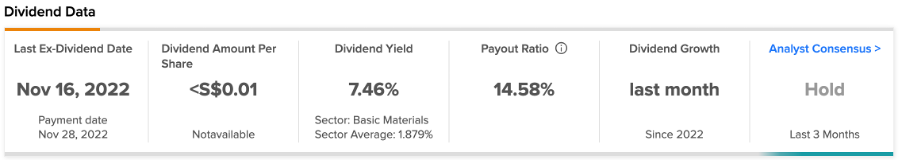

With a dividend yield of 7.46%, the company tops the chart in the Singapore market. The company has a policy of distributing around 30% of its underlying profits as dividends. In its first-half results, the company announced an interim dividend of S$0.008 per share, depicting a growth of 51% over the first half of the previous year.

Moving forward, the company is optimistic about its future due to its consistent dividend payments and increased profitability, which are being fueled by the rising demand for palm oil globally. With rising populations and per capita income, the processed food industry is poised for expansion, driving up demand for palm oil.

The stock is also trading at a low P/E ratio of 3.3, which makes it undervalued as compared to its industry peers. This presents a buying opportunity for investors looking for dividend income as well as share price appreciation.

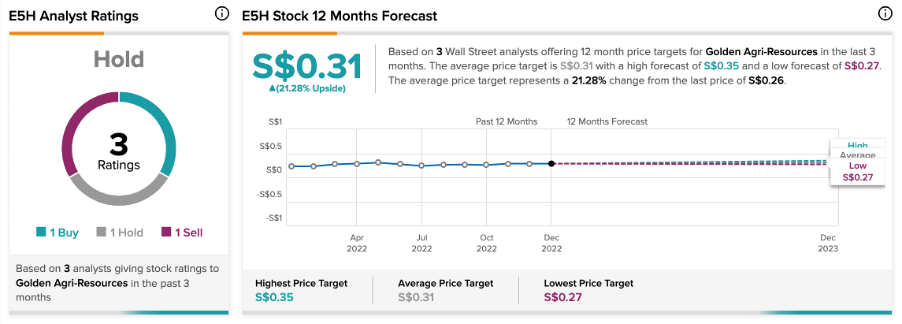

Golden Agri-Resources Target Price

According to TipRanks’ rating consensus, Golden Agri-Resources’ stock has a Hold rating.

The average target price is S$0.31, which has an upside potential of 21.7% from the current price level.

Singapore Telecommunications Ltd. (Singtel)

As a leading telecommunications group in Asia, Singtel enjoys a dominant position in the market with stable top-line growth.

The company’s first-half results demonstrated good progress as the business recovered following the opening of economies. The analysts are expecting the earnings momentum to continue in the third quarter and above, driven by higher roaming revenues. Non-core asset sales will also help earnings in the medium to long term.

The stock has been trading up by 15.7% YTD, after having fallen by 14% in the last three years.

Peeking into its dividends, the company declared an interim dividend of S$0.046 per share, representing a payout of 76% of the net profits. Even though its yield of 4.64% is lower than that of Golden Agri-Resources, Singtel’s dividend payments are consistent and stable, making it a safer stock.

The company’s solid financial position also makes the dividend story quite appealing. Singtel has reduced its debt by S$3.4 billion as compared to last year and has also locked in the remaining debt at fixed interest rates.

Is Singtel a Buy Now?

Based on eight Buy ratings, Singtel’s stock has a Strong Buy rating on TipRanks. The average target price of S$3.15 depicts a growth of 22% on the current price level.

Final Thoughts

To conclude, both Golden-Agri Resources and Singtel look like good dividend payers, backed by stable earnings growth.

Special end-of-year offer: Access TipRanks Premium tools for an all-time low price! Click to learn more.