Mapletree Industrial Trust (SG:ME8U) (MIT) is a real estate investment trust based in Singapore. The company owns a diversified portfolio of assets that are mainly used for industrial purposes.

As of March 31, 2023, MIT’s total assets under management amounted to S$8.8 billion. This impressive sum is made up of 85 properties located in Singapore and an additional 56 properties situated in North America.

Improving Metrics, But Challenges Persist

The company’s share price has been volatile over the last year, with a return of just 2.4%. This was mainly due to the rising interest rates and significant inflation that have impacted the share prices of REITs.

However, the stock started the year 2023 on a favorable note and has been trading up by 7% YTD. As economies reopen and occupancy rates rise, Mapletree is observing positive developments in its operating metrics. However, it is important to note that economic challenges still persist.

In April, the company reported its annual earnings for the fiscal year 2022-23 with a mixed set of numbers. During the year, there was notable year-on-year growth in gross revenue and net property income, with increases of 12.3% and 9.7%, respectively, reaching S$684.9 million and S$518.0 million. The company did face headwinds such as higher operating expenses and borrowing costs, which impacted its financial performance.

Moving forward, the company is optimistic about its newly completed Mapletree Hi-Tech Park at Kallang Way, which will make a gradual contribution in FY 2023-2024.

Analysts’ View

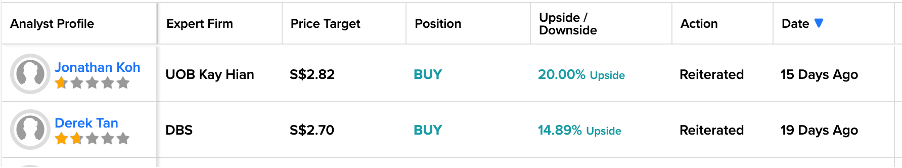

After the release of FY2023 results, analysts from UOB Kay Hian and DBS have maintained their Buy recommendations on the stock. The analysts believe the numbers met their expectations and demonstrated the income resilience of Mapletree Industrial Trust’s diversified portfolio.

19 days ago, DBS analyst Derek Tan reiterated his Buy rating on the stock and anticipates an upside of almost 15% in the share price. Tan feels the upcoming quarters will be more favorable if the supply chain disruptions are handled smoothly.

15 days ago, Jonathan Koh from UOB Kay Hian also confirmed his Buy rating on the stock with an expected 20% growth potential.

Is Mapletree Industrial a Good Buy?

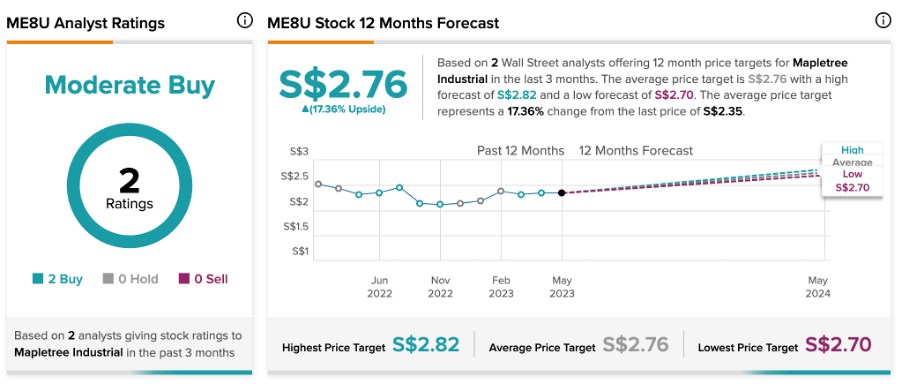

According to TipRanks, ME8U stock has a Moderate Buy rating, based on two Buy recommendations.

The average price forecast is S$2.76, which has an upside of 17.3% on the current price level.

Conclusion

To summarize, MIT presented a mixed set of results for FY22/23. Although there was a slight decline in the distribution per unit (DPU), the new developments remain healthy. In the future, possible catalysts include a rebound in industrial rents and more acquisitions.

Overall, it is essential for investors to closely monitor MIT for any indications of a decline in its financial performance.