The stocks of Liontown Resources Limited (AU:LTR) and Core Lithium (AU:CXO) have been riding high on the success of lithium adoption globally.

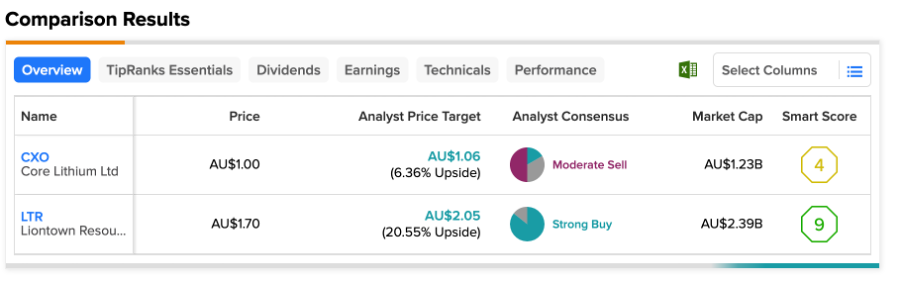

Among these two stocks, analysts remain more bullish on LTR stock, with a Strong Buy rating. On the other hand, CXO stock has a Moderate Sell rating from analysts.

Here, to check all the stocks from a particular sector, we have used the TipRanks Top Australian Basic Materials Stocks page. This makes it easy to screen and compare the stocks in the same sector and make the right choice accordingly.

Let’s have a look at the details.

Liontown Resources Limited

Liontown is an Australian company that produces battery minerals used in electric vehicles and the energy storage sector.

The company is currently exploring a potential refinery at Kathleen Valley, which will be the world’s largest lithium mine. This mine will supply around 5,00,000 tonnes of lithium oxide concentrate annually starting in 2024. In January, the company also announced that its capital expenditure on the project had increased from AU$545 million to AU$895 million.

YTD, the stock has been trading up by 38% despite the recent decline in lithium prices. Investors basically bought more shares on the dip after the stock hit a low point in February.

Analysts feel that the company will take some time to generate healthy cash flows and dividends. However, it still remains an attractive pick in the sector.

Is LTR a Good Investment?

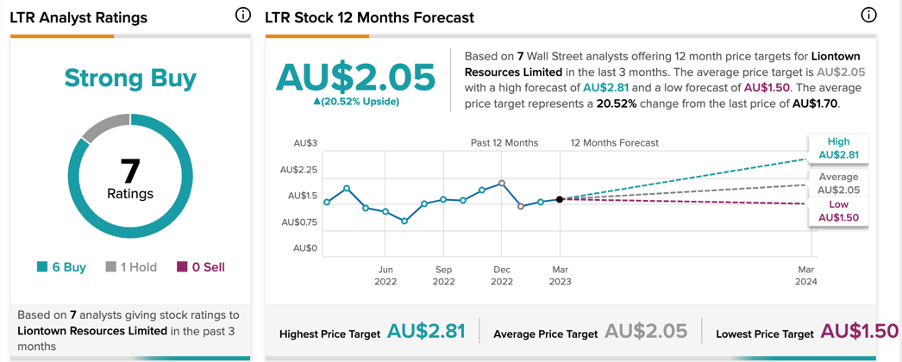

According to TipRanks’ analyst consensus, LTR stock has a Strong Buy rating, based on six Buy and one Hold recommendations.

The average target price is AU$2.05, which is 20% higher than the current level.

Core Lithium Limited

Core Lithium is an Australian mining company focused on lithium, copper, zinc, and lead projects.

After giving stellar returns of more than 3000% in the last three years, the stock has fallen by 37% in the last six months.

The company is on track to start production on its Finniss Lithium Project in the Northern Territory, Australia. The company will initially produce 160 thousand metric tonnes of lithium concentrate over 12 years of operations.

Today, the company announced its first-half results for the fiscal year 2023. During this period, the company generated losses of AU$9.2 million, which increased three times as compared to the previous year. However, this was expected as the company is investing heavily to start its production on a large scale.

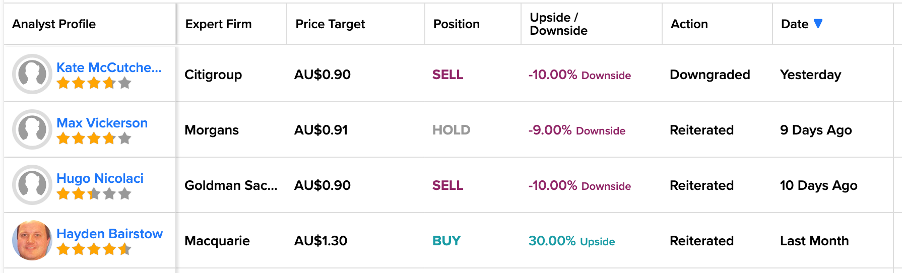

Analysts have given the stock mixed reviews following the results. Macquarie has a Buy rating on the stock and sees an upside of 30% in the share price. On the other hand, analyst Kate McCutcheon from Citigroup downgraded her rating to Sell on the stock yesterday.

Is Core Lithium a Good Stock?

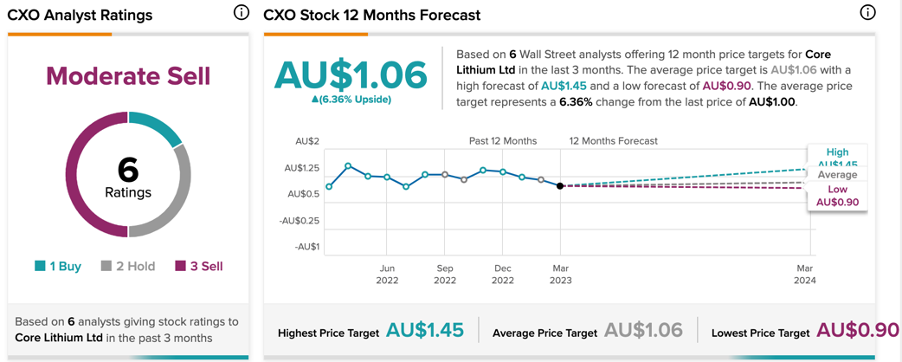

According to TipRanks, CXO stock has a Moderate Sell rating based on three Sell, one Buy, and two Hold recommendations.

The average target price of AU$1.06 is 63% higher than the current level.

Ending Notes

Australia has become a hub for lithium-producing companies and has attracted a lot of attention from investors. The sector has generated a lot of excitement from investors but is also volatile.

Among these two stocks, analysts are more bullish on Liontown based on its upcoming lithium refinery, which will start production in 2024.

On the other hand, Core Lithium has mixed views from analysts with an overall Moderate Sell rating.