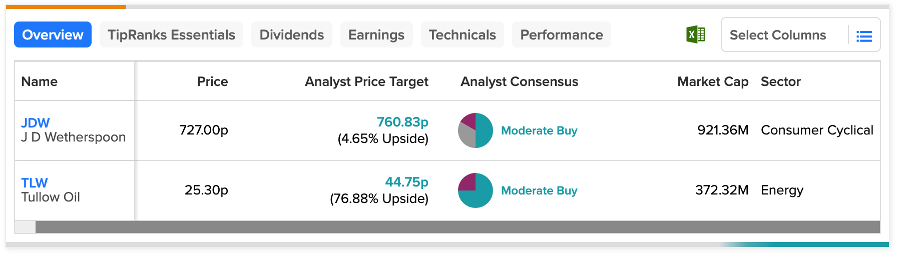

UK-based J D Wetherspoon (GB:JDW) and Tullow Oil (GB:TLW) have gained analysts’ support with Moderate Buy ratings. Tullow Oil offers significant upside potential for over 75% growth in its share price. On the other hand, JDW, already trading at higher levels, offers a modest growth opportunity of around 5%.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Let’s take a look at the details.

J D Wetherspoon PLC

J D Wetherspoon owns a chain of pubs and hotels in the UK and Ireland, providing alcoholic and non-alcoholic drinks, food items, and coffee at its branches.

Wetherspoon has kicked off the year 2023 on a high note, achieving remarkable trading levels and witnessing a significant increase of 60% in its share price YTD. The pub chain’s sales have rebounded impressively, surpassing pre-pandemic levels. In the 13-week period ending in April 2023, like-for-like sales were 9% higher compared to the corresponding period in 2019. The company anticipates an exceptional performance for the entire year, projecting its highest-ever sales, increased profits, and reduced debt.

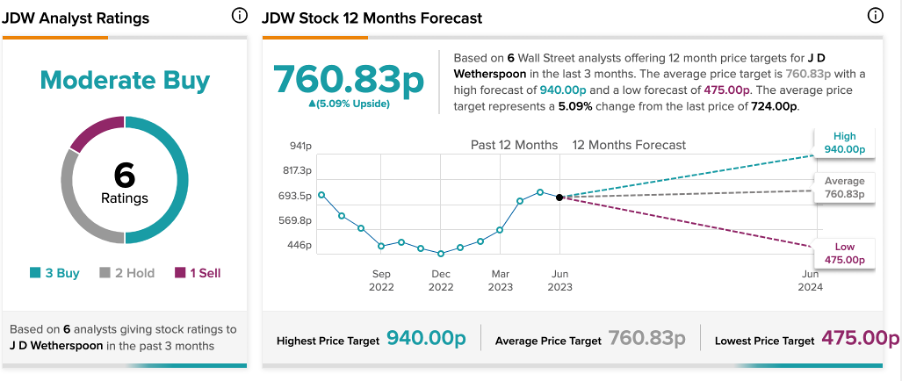

13 days ago, HSBC analyst Joseph Thomas upgraded his rating on the stock from Hold to Buy. His price target of 940p suggests an upside of almost 30% in the share price.

Is JD Wetherspoon a Good Stock to Buy?

According to TipRanks’ analyst consensus, JDW stock has a Moderate Buy rating with three Buy, two Hold, and one Sell recommendations.

The average price target is 760.83p, which is 4.5% higher than the current price level. The price has a high forecast of 940p and a low forecast of 475p.

Tullow Oil PLC

Tullow Oil is an oil and gas exploration company with assets in Africa and South America.

In contrast to J D Wetherspoon, Tullow Oil’s share price has been struggling with a 30% decline YTD. However, the company posted solid numbers in its annual earnings for 2022. The revenues for the year increased by around 40% to $1.78 billion, as compared to the previous year. The company also posted profits after tax of $49 million, after posting a loss of $81 million in 2021.

Looking ahead, the company is confident that the positive momentum across its portfolio will contribute to another year of profitable growth. The company’s projects in Jubilee South East and Kenya are progressing as planned, indicating higher production figures. In general, the company expects stable output numbers but lower cash flows for the year 2023.

19 days ago, James Hosie from Barclays reiterated his Buy rating on the stock, predicting a huge upside of over 90% in the share price.

Is Tullow Oil a Good Buy?

TLW stock has a Moderate Buy rating on TipRanks, backed by three Buy and one Sell recommendations.

The average price forecast is 44.75p, which represents a growth of 78.7% on the current price level.

Conclusion

Both JDW and TLW have received favorable ratings from analysts. For TLW, analysts express a highly bullish sentiment towards its prospects and anticipate a share price growth rate of over 75%. Conversely, JDW is seen to have more limited growth potential, with projections of a 5% increase, as the stock is already trading at elevated levels.