Shares of Australia-based retailer JB Hi-Fi Limited (AU:JBH) flew to a new 52-week high of AU$60.79 today, following better-than-expected results for six months ending December 31, 2023. For the first half of Fiscal 2024, sales fell 2.3% to AU$5.16 billion, less than the decline anticipated by analysts. Also, after-tax profit declined 19.9% year-over-year to AU$264.3 million due to inflationary pressures, but came in better than the consensus expectations.

JB Hi-Fi Limited is an Australian consumer electronics and home appliances retailer. It operates through three segments: The Good Guys, JB Hi-Fi Australia, and JB Hi-Fi New Zealand. JBH shares have gained nearly 37% in the past year.

Details About JB Hi-Fi’s Half-Year Results

As compared to the prior year period, sales from The Good Guys chain fell 9.9%. JB Hi-Fi Australia saw a marginal 0.7% rise in its top line, while JB Hi-Fi New Zealand sales increased by 5.1%.

Because of the weak results, JB Hi-Fi slashed its dividend per share by 19.8% year-over-year to AU$1.58 from AU$1.97. The dividend is payable on March 8, 2024, to shareholders of record on February 23.

JB Hi-Fi has witnessed a slump in demand for electronic goods as price-sensitive consumers fight off inflationary pressures and a high-interest rate environment. The company’s reported results also faced tougher comps from last year when the demand was at its peak levels. Having said that, JB Hi-Fi expects sales to pick up momentum in the near term in anticipation of potential interest rate cuts.

Notably, JB Hi-Fi did not issue any guidance for the second half of the Fiscal 2024, but did give a trading update. The company said that its January 2024 sales were in line with expectations. Compared to January 2023, JB Hi-Fi Australia sales were up 2.5%, JB Hi-Fi- New Zealand sales grew 8.2%, while The Good Guys sales were down 2.2%.

Is JB Hi-Fi a Good Stock to Buy?

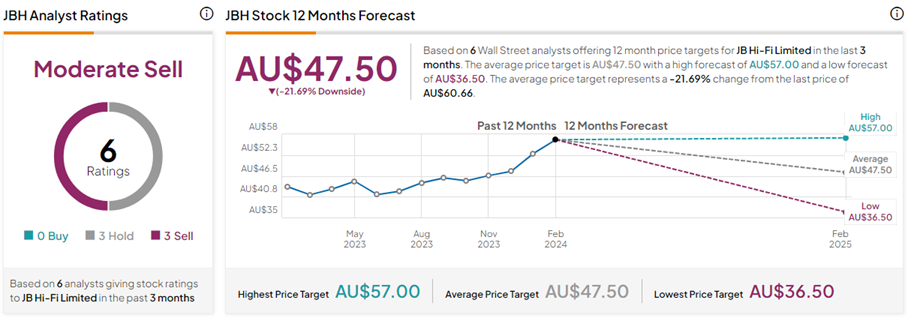

With three Holds versus three Sell ratings, JBH stock has a Moderate Sell consensus rating on TipRanks. The JB Hi-Fi share price forecast of AU$47.50 implies 21.7% downside potential from current levels. All these ratings were given before the results announcement and are subject to change.