Shares of the DAX 40-listed Infineon Technologies AG (DE:IFX) have garnered praise from analysts, who see further upside despite the stock already witnessing a strong year-to-date rally. IFX shares have gained 28.1% so far in 2023, and analysts expect a further 22.1% upside potential over the next twelve months. Infineon has been flooded with Buy recommendations after it reported solid fourth-quarter Fiscal 2023 results. Plus, the company increased its dividend payment to €0.35 per share, supporting the view for accelerated growth in the upcoming quarters.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Infineon Technologies is a German semiconductor giant catering to diverse sectors, including automotive, industrial, telecommunications, and security solutions.

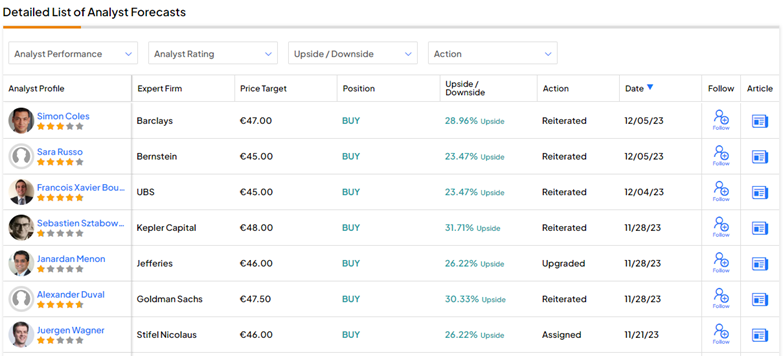

In December alone, three analysts reiterated their Buy targets on IFX stock and set attractive price targets.

Analysts Shower IFX With High Price Targets

For FY23, Infineon reported a 15% jump in revenue to €16.3 billion, driven by strong demand for semiconductors in the automotive and renewable energy sectors. For FY24, Infineon expects revenue of roughly €17 billion (plus or minus €500 million). The company’s optimistic outlook is aided by sustained market leadership despite the tough macro backdrop, which is the driving factor behind analysts’ bullish view.

UBS analyst Francois Xavier Bouvignies and Bernstein analyst Sara Russo have both set a price target of €45 on IFX stock. The price represents 23.5% upside potential from current levels.

At the same time, Barclays analyst Simon Coles is slightly more bullish on IFX and set a price target of €47, implying nearly 29% upside potential to the current levels.

Is Infineon a Good Buy?

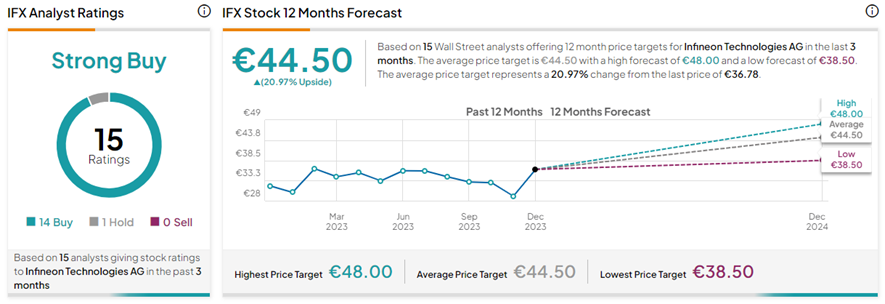

With 14 Buys and only one Hold rating, IFX stock commands a Strong Buy consensus rating on TipRanks. The Infineon Technologies share price forecast of €44.50 implies nearly 21% upside potential from current levels.