The DAX 40-listed Infineon Technologies AG (DE:IFX) share price has garnered Buy ratings from analysts after its Q4 2023 earnings announcement this week. Analysts remain upbeat about the stock’s potential and have confirmed their Buy recommendations, predicting more growth.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Post-results, around nine analysts have reiterated their ratings, of which seven are Buy. Yesterday, analysts from Deutsche Bank, Warburg, UBS, and Goldman Sachs recommended buying the stock. Analyst Sebastien Sztabowicz from Kepler Capital has predicted a growth rate of 47% in the share price.

Analysts are bullish on the future prospects, considering the strong financial performance of the company and its capacity to sustain market leadership even amid economic downturns.

Infineon Technologies is a German semiconductor manufacturing company with a broad market presence. It caters to diverse sectors, including automotive, industrial, telecommunications, security, and various other industries.

Robust Performance

Two days ago, the company reported a net profit of €753 million in Q4, surpassing analysts’ forecasts of €674.8 million. It was 2% above the profit reported in the same quarter last year. The revenue was flat at €4.15 billion as compared to last year but grew by 1% on the previous quarter’s figure of €4.09 billion. Revenue increased by 15% to €16.3 billion for the full year 2023. The segment result in 2023 was €4.4 billion, marking a huge growth of 30% on a year-over-year basis. The segment result margin reached 27%.

For the fiscal year 2024, Infineon has set a revenue target of almost €17 billion, signaling a year-over-year growth of 4%. However, the company anticipates a slightly lower segment result margin of around 24%.

In terms of shareholders’ returns, Infineon has declared an increase in its dividend payout, raising it from €0.32 to €0.35 per share. This move demonstrates confidence in its financial strength and future outlook and is expected to be positively received by shareholders.

What is the Target Price for Infineon Share?

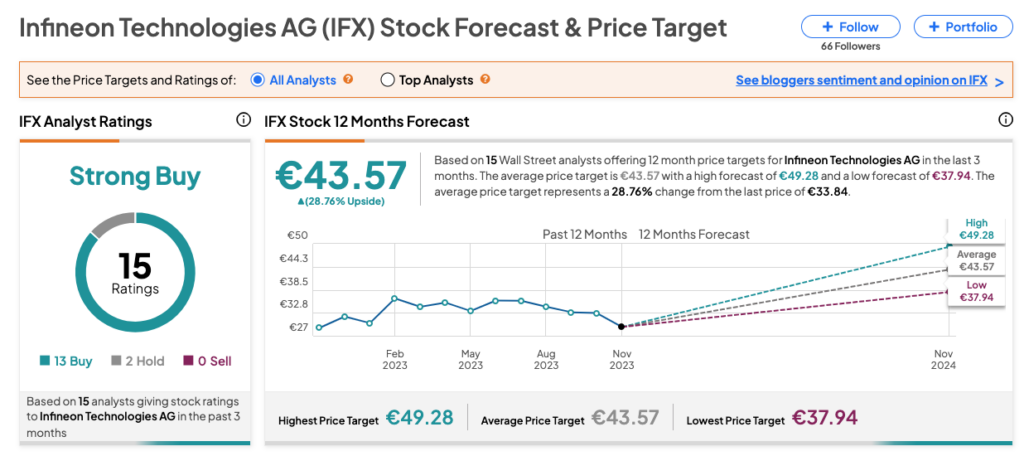

According to TipRanks, IFX stock has a Strong Buy rating, backed by a total of 15 recommendations from analysts. It includes 13 Buy and two Hold ratings.

The Infineon share price target is €43.57, which represents a 28% change from the current price level.