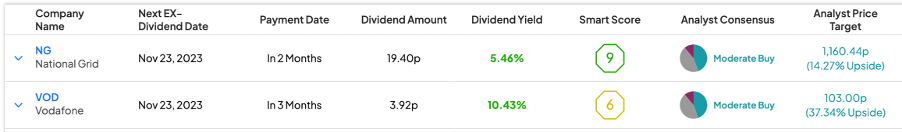

Using the TipRanks Dividend Calendar tool for the UK market, we have shortlisted Vodafone Group PLC (GB:VOD) and National Grid PLC (GB:NG), which are set to go ex-dividend this week. These stocks present investors with a chance to acquire them and become eligible for the upcoming dividend payout.

In terms of share price growth, both stocks have been rated as Moderate Buy.

TipRanks provides a range of tools to assist users in finding suitable dividend stocks that align with their preferences. The Dividend Calendar tool simplifies the process of screening and choosing stocks by highlighting those with upcoming payment schedules.

Let’s take a look at the details.

Vodafone Dividend Date 2023

Vodafone stands as a prominent European telecommunications company, providing a range of services including voice, messaging, and internet connectivity for both fixed and mobile networks.

The company currently has an attractive dividend yield of 10.69%. For the fiscal year 2024, Vodafone announced an interim dividend of 4.5 euro cents per share, payable in February 2024. The ex-dividend date for the stock is Thursday, November 23.

Last week, the company published its half-yearly results for FY24 with improved revenues across all its markets. The total revenue declined by 4.3% to €21.9 billion; however, the service revenue grew by 4.2% in the first half. The favorable results are attributed to strategic price increases implemented across its major markets. The company reaffirmed its full-year earnings guidance, addressing potential investor concerns and instilling confidence in both its outlook and dividend prospects.

Are Vodafone Shares a Good Buy?

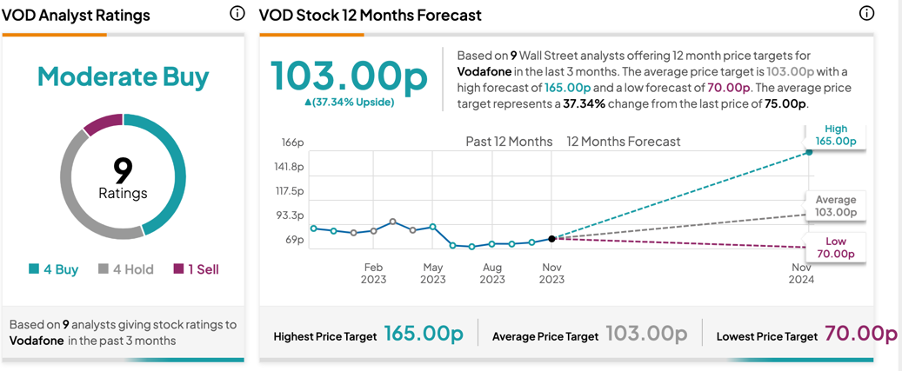

According to TipRanks, VOD stock has a Moderate Buy rating based on a total of nine recommendations. The average price forecast is 103p, with a high forecast of 165p and a low forecast of 70p. The Vodafone share price target implies an upside of 37% on the current trading levels.

What is the Next National Grid Dividend 2023?

National Grid is a British utility company that specializes in the transmission and distribution of electricity.

The company declared a half-year dividend of 19.4p per share for the fiscal year 2024, payable on January 11, 2024. This was higher than the interim dividend of 17.84p per share paid in FY23. The ex-dividend date for the stock is November 23, 2023.

In its interim results for FY24, National Grid has experienced a decline in pre-tax earnings, dropping by 18% to £1.37 billion year-on-year. Similarly, operating profits have decreased by 11%, sliding from £2.24 billion to £1.99 billion over the same period. The company stated that its earnings were hit by non-recurring costs and other insurance expenses.

The company anticipates that underlying earnings per share for 2023-24 will be lower compared to the previous year due to changes in UK government legislation regarding capital allowances. However, it remains bullish on its long-term goals and has increased its five-year financial framework for the period from 2020/21 to 2025/26.

Is National Grid a Good Stock to Buy?

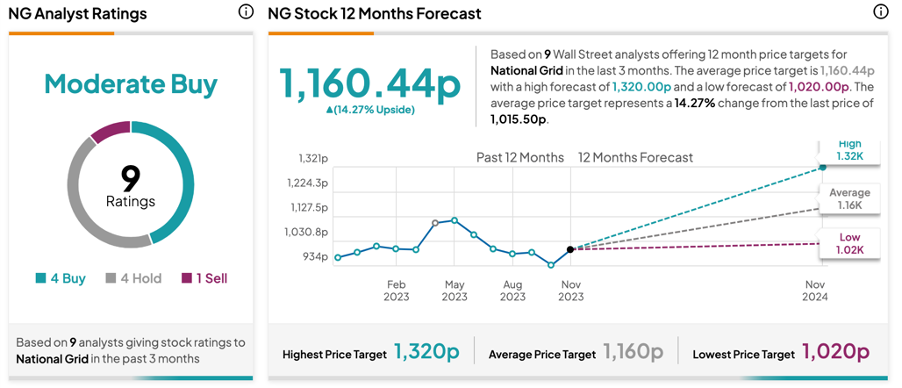

NG Stock has a Moderate Buy rating on TipRanks, backed by four Buy, four Hold, and one Sell recommendations. The National Grid share price prediction is 1,160.4p, which is 14.3% above the current level.