The Spanish financial companies CaixaBank S.A. (ES:CABK) and Banco Santander S.A. (ES:SAN) offer more than 30% upside potential and could be the right opportunity for investors looking for growth. According to analysts’ assessments, both of these stocks have received Moderate Buy ratings.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Both companies are also good dividend payers in the Spanish market, ticking the box for income investors as well.

We have utilized the Stock Comparison tool for Spain to analyze these stocks on various parameters. This tool provides investors with comprehensive analysis and up-to-date information on different companies, making their investment decision-making process easier.

Let’s take a look at some details.

CaixaBank S.A.

CaixaBank is among the leading banks in Spain, serving more than 20 million customers.

In July, the bank published its half-yearly earnings for 2023, surpassing analysts’ estimates. It posted a growth of 48% in net profits of €1.28 billion. The numbers were mainly driven by its net interest income (NII), which grew by 61% during the first half. For the full year, the bank is expecting a growth rate of 30% in its NII for 2023.

Analysts remain bullish on the stock, considering its progress on its strategic plan for two years ending in 2024. As part of this plan, the group intended to strengthen its operational performance and deliver attractive returns to its shareholders. As part of this plan, the bank is also aiming to achieve a ROTE (return on tangible equity) of over 12% by 2024, up from 7.2% in 2021. ROTE is frequently used by banks and stands as a robust indicator of their profitability.

CaixaBank Share Price Forecast

According to TipRanks’ analyst consensus, CABK stock received a Moderate Buy rating based on a total of 10 recommendations. The consensus is based on seven Buy versus three Hold recommendations. The average price target is €5.0, which suggests a growth of 32.3% from the current trading level.

Banco Santander S.A. (Santander Group)

Santander Group is the largest financial institution in Spain and provides banking, wealth management, and other services to its customers.

Santander also posted encouraging results in July in its half-yearly earnings report for 2023. The bank witnessed a 7% expansion in its attributable profit, reaching €5.2 billion, as opposed to the corresponding period in the previous year. The total income for the period surged by 13% to €28.3 billion, which was primarily fueled by strong figures in Europe. Furthermore, net interest income experienced a 15% rise, attributed to elevated interest rates in Europe.

It also gained 80 basis points in its ROTE of 14.5%, which signifies more profitability for the company and enhanced returns for shareholders.

Is Banco Santander Stock a Buy?

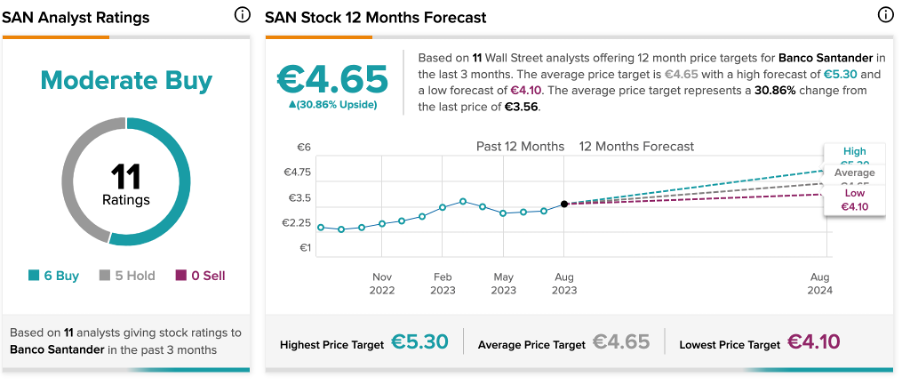

SAN stock has received a Moderate Buy rating on TipRanks, backed by six Buy, one Hold, and one Sell recommendations. The average price target is €4.65, which is around 30.8% higher than the current trading levels.

Conclusion

Following their earnings announcements, analysts hold a positive outlook for both CaixaBank and Banco Santander. They believe these stocks have the potential to achieve an additional 30% growth in their individual share prices.