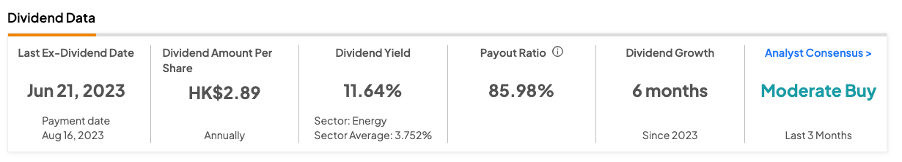

HSI-listed China Shenhua Energy Co. Ltd. (HK:1088) carries a dividend yield of 11.64%, surpassing the industry average of 3.75%. The company has been a consistent dividend payer in the Hong Kong market.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

China Shenhua Energy is a coal company engaged in mining, production, transportation, and power generation. It operates as a subsidiary of the state-owned China Energy Investment Corporation.

Also, the stock offers an attractive upside potential, as discussed below.

TipRanks offers a wide range of dividend tools across different markets to make the selection process easy for users.

China Shenhua Energy Dividends

China Shenhua follows an annual dividend payout schedule. For Fiscal year 2022, the company approved a final dividend of ¥2.55 or HK$2.89. This was slightly higher than the dividend payment of ¥2.54 for FY21 but lower in terms of Hong Kong dollars (HK$3.11).

In its third-quarter results for FY23, the company posted a decline of 23% in the profit attributable to equity holders. Revenue fell by over 2%. The decline was mainly attributed to lower coal prices and higher production costs.

Despite a weak operating performance, the company is steadfast in paying dividends. Dividend payments underwent a significant downturn after reaching a peak in 2017, but have recovered over the past two years.

The company recently reported its monthly production numbers for November. Commercial coal production reached 27.3 million tonnes, marking an increase from the 26.0 million tonnes reported the previous year. Additionally, gross power generation increased to 17.95 billion kWh (kilowatt hour) from 15.37 billion kWh in the corresponding period a year ago.

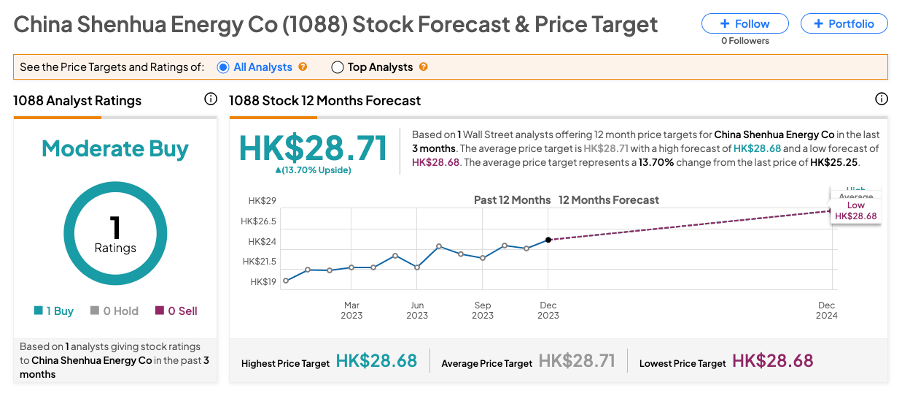

China Shenhua Energy Share Price Target

According to TipRanks, 1088 stock has a Moderate Buy consensus rating based on one Buy recommendation from Citi. The China Shenhua share price target is HK$28.71, which is 14% higher than the current price level.