In important news for Hong Kong-listed stocks, Xiaomi Corp. (HK:1810) is making a big push toward premium electric vehicles (EVs) in China. The smartphone maker aims to leverage its massive existing base of 20 million customers, targetting them as the initial buyers of its premium EVs.

In an interview with CNBC, Xiaomi Group President Weibing Lu said that placing its recently launched premium SU7 model in the premium category made more sense since the low and mid-range segments were undergoing intense price wars in China. Xiaomi has spent $10 billion toward the research and development of EVs.

Here’s All About Xiaomi’s EV Plans

Lu said that the first deliveries of the SU7 should be expected in the second quarter of 2024. The company is yet to finalize a price tag for the car. Lu noted that the company is building an entire ecosystem based on its new HyperOS operating system. The system involves the use of artificial intelligence (AI) to learn and adapt customer behaviour from its products. The system will also align the user’s smartphone, home, and EV under one single accord.

Importantly, Lu predicts that ten to 20 years down the line, roughly 70% of the EV market will be controlled by the largest five players, similar to the state of the current smartphone market. Currently, Xiaomi gets its autos manufactured by a third party on a contractual basis but plans to manufacture most of its parts in-house in the future.

Moreover, Xiaomi is looking at the export markets to drive higher EV sales, much like its smartphones, which have gained huge popularity internationally.

Is Xiaomi Stock a Good Buy?

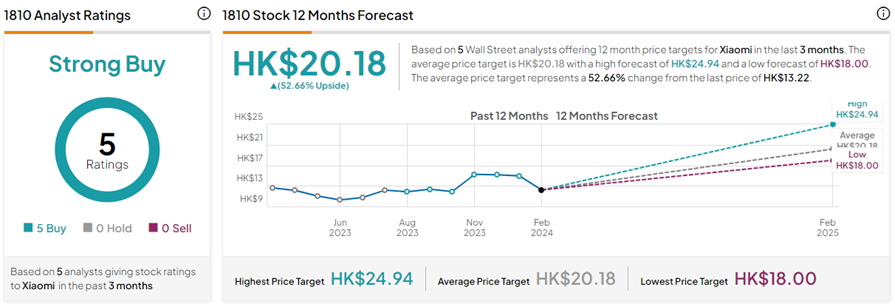

Today, CLSA analyst Elinor Leung reiterated a Buy rating on Xiaomi shares with a price target of HK$19.70 (49% upside).

With five unanimous Buy ratings, 1810 stock commands a Strong Buy consensus rating on TipRanks. The Xiaomi Corp. share price forecast of HK$20.18 implies 52.7% upside potential from current levels.