China-based smartphone maker Xiaomi (HK:1810) unveiled its first electric vehicle (EV), called SU7, at the Stride launch event in Beijing event on Thursday. The SU7 will be manufactured by state-owned Beijing Automotive Industry Holding Co. Ltd (BAIC). At the event, CEO Lei Jun said that the company will emerge as the world’s top five automakers by “working hard over the next 15 to 20 years.”

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Xiaomi’s Aggressive EV Goals

In a post on social media platform X, CEO Jun said that the SU7 is in trial production and will be rolled out in the domestic market in a “few months.” He also said that the price of the EV has not been finalized yet.

The company is making its debut in the EV market at a time when competition is intense and macro pressures are impacting demand. The SU7 EV will be available in three variants – SU7, SU7 Pro and SU7 Max. The company has not yet revealed the EV’s price details.

At the Thursday event, the CEO said that the Xiaomi SU7 is better than Porsche’s (DE:PAH3) Taycan and Tesla’s (NASDAQ:TSLA) Model S when it comes to acceleration and certain other parameters. The CEO added that the Xiaomi is “a dream car comparable to Porsche and Tesla”.

The SU7 will run on Xiaomi’s HyperOS operating system and seamlessly connect with the company’s smartphone and smart home accessories.

Xiaomi is aggressively expanding into the EV space and has spent over 10 billion yuan to develop its first EV prototype. In 2021, the company committed to invest $10 billion in EVs over the next 10 years.

Is Xiaomi a Good Stock to Buy?

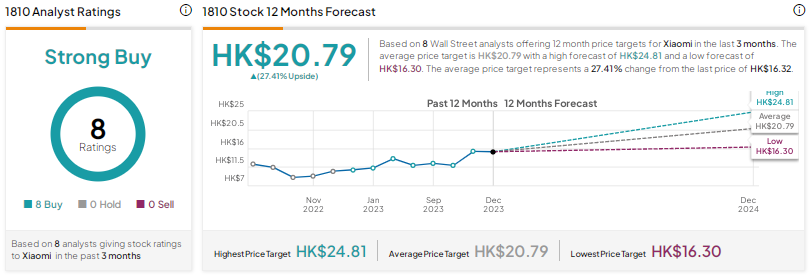

Xiaomi earns a Strong Buy consensus rating based on eight unanimous Buys. The average price target of HK$20.79 implies 27.4% upside potential. Shares have rallied 49% year-to-date.