Among the major Hong Kong stocks, Li Auto, Inc. (HK:2015) launched its new mid-size SUV L6, with an aggressive pricing strategy to undercut its U.S.-based rival Tesla’s (NASDAQ:TSLA) market share. The company has priced its model starting at ¥249,800 ($34,500), marking a 5% reduction compared to Tesla’s well-received Model Y. With this move, Li Auto aims to broaden its customer reach and secure a larger market share amid the growing competition within China’s EV market. However, the market responded negatively and shares traded down by 7.4% on Friday.

Li Auto is a leading Chinese automobile manufacturer, offering a range of smart electric vehicles (EVs).

Battle of the EVs: Li Auto’s Bold Move

Li Auto will begin the delivery for the L6 next week, and upgraded models will be available at higher points. Li Auto’s L6 emerges as the most affordable offering from the company, yet it’s positioned as the ultimate choice within its price range. However, in terms of battery range, the L6 provides a range of up to 212 km on a single charge, while Tesla’s Model Y has a range of 554 km.

Experts believe that various SUVs in China are considered competitors to Tesla’s Model Y, but none have posed a significant challenge to Model Y’s dominance thus far. The Model Y saw a remarkable 64% year-over-year improvement in 2023, achieving a total of 1.23 million units, claiming the top spot globally.

Deutsche Bank’s View on L6

According to Deutsche Bank, the L6 model is poised to drive Li Auto’s sales growth this year, especially after the dull response of its previous model, Li Mega. Analyst Edison Yu from Deutsche Bank believes L6 should generate a robust order backlog for the company but will surely face higher competition in the market. The company is targeting monthly sales of 30,000 units for L6. However, Edison and his team feel the company will have to invest heavily in promotional activities to reach this target.

Following its launch last month, Li Mega also failed to meet expectations, leading the company to revise its overall delivery target. The company has reportedly reduced its forecast range for 2024 to 560,000 and 640,000 units, down from the earlier forecast of 650,000 to 800,000 units.

Is Li Auto Inc. a Good Investment?

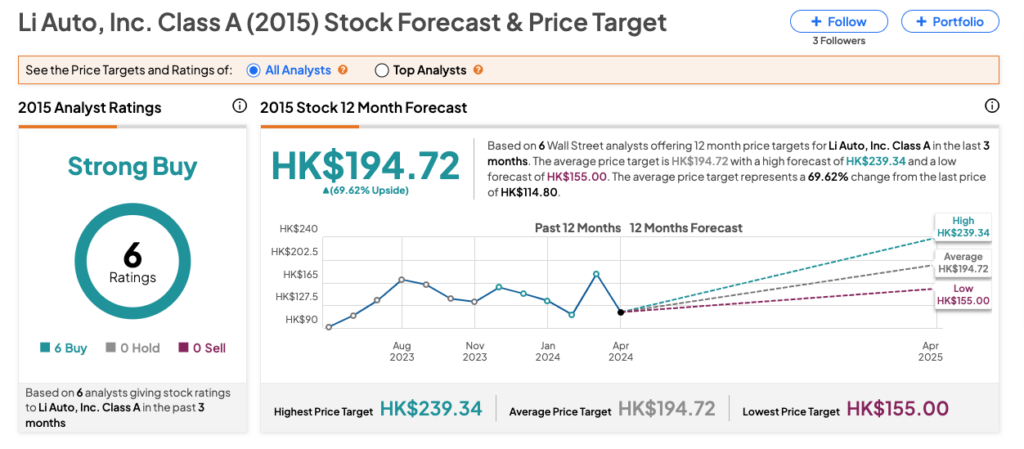

On TipRanks, 2015 stock has been assigned a Strong Buy rating, backed by Buy recommendations from all six analysts covering the stock. The Li Auto share price target is HK$194.72, which is 70% above the current price level.