Trifast plc (GB:TRI) shares plunged nearly 29% in early morning trade today following a sales warning from Britain’s industrial goods manufacturer. In a Q3 FY24 trading update released this morning, Trifast cited subdued demand and excess inventory levels at customers as two challenges impacting its performance.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Trifast designs, manufactures, and distributes high-quality industrial fastenings and Category ‘C’ components. Its customers include global assembly players across the UK, Europe, USA, and Asia.

Further Details About Trifast’s Q3 Update

While releasing its first half of Fiscal 2024 results, Trifast had warned of continued deterioration in demand conditions in several end markets and geographies. Even though the company expected the conditions to improve, Q3 FY24 was also marred by demand challenges and excess inventory issues. Importantly, Trifast expects the headwinds to continue well into the end of FY24 and slashed its full-year outlook accordingly.

Owing to the above reasons, management now expects revenues of £230 million with an adjusted EBIT (earnings before interest and tax) margin of 5%. The company was already working on cost-cutting measures to improve profit margins, but unfortunately, those proved inadequate to cover the shortfall in revenues.

Is Trifast a Buy?

Trifast has been hounded by performance challenges since 2023 and expects them to persist this year. Under such circumstances, Trifast has decided to lay off an additional 10% of its non-operational staff worldwide. Trifast expects this move to contribute additional annualized cost savings of £3 million.

Plus, the group hopes to lower its leverage ratio to below 1.5x by effectively managing working capital requirements and cash. Trifast will give further details about its restructuring efforts when it releases the final results for the year ending March 31, 2024, in July 2024.

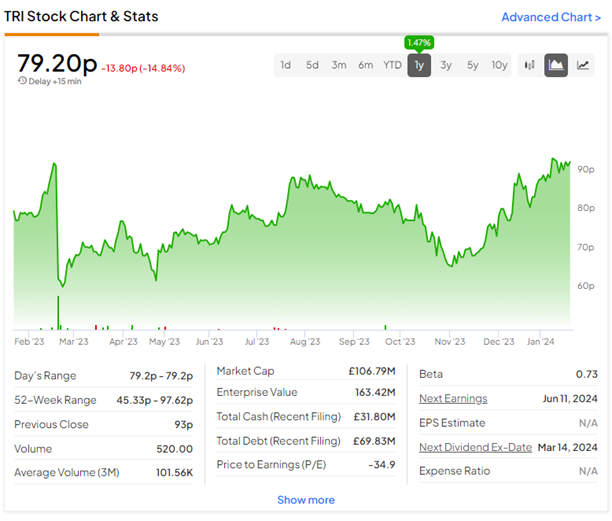

TRI shares had gained over 15% in the past year, excluding the massive plunge from today. Shares are trading at a heavy discount to its 52-week high price of 97.62p.