Shares of ASX 100-listed Liontown Resources Ltd (AU:LTR) are down 8.3% as of writing following the news of royalty litigation regarding the Kathleen Valley project. Private royalty holder Drem Pty. Limited (Drem) has filed a lawsuit asking for clarification on the amount of royalty owed from certain tenements at the project.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Liontown Resources is a mineral exploration and development company focused on lithium mining. It aims to be a significant provider of battery minerals to the rapidly growing clean energy market. Liontown’s Kathleen Valley project is located in Western Australia. It is considered a Tier-1 battery metals asset with one of the largest and highest-grade hard rock lithium deposits in the world. The project is in the development stage, with the first production targeted for mid-2024.

Further Details about the Lawsuit

Liontown is a party to a royalty deed concerning the inherited private royalty applicable to certain tenements that are part of the project. Drem is seeking declarations regarding the interpretation of the relevant documents and the amount of royalty owed. Importantly, Drem wants to know whether the amount of royalty is calculated at 2% or lower of gross production sales from the relevant tenements.

In a public notice, Liontown acknowledged the receipt of the lawsuit and said that it would respond soon. Liontown also mentioned that it does not believe that Drem’s claim will have any material impact on the company or the planned production scheduled for mid-2024.

Is Liontown Resources a Good Buy?

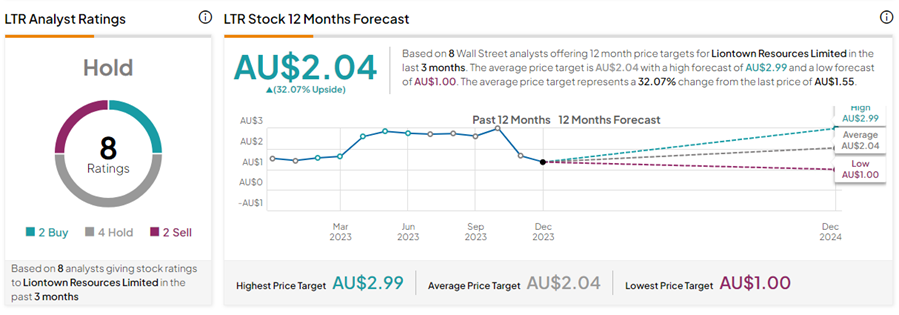

Following the news of the royalty case, Macquarie analyst Adam Baker downgraded LTR stock to Hold from Buy. Further, the analyst cut the price target for LTR stock to AU$1.60 (3.4% upside) from AU$2.70.

Overall, with two Buys, four Holds, and two Sell ratings, LTR stock has a Hold consensus rating on TipRanks. The Liontown Resources share price forecast of AU$2.04 implies 32.1% upside potential from current levels. Year-to-date, LTR shares have gained 17.2%.