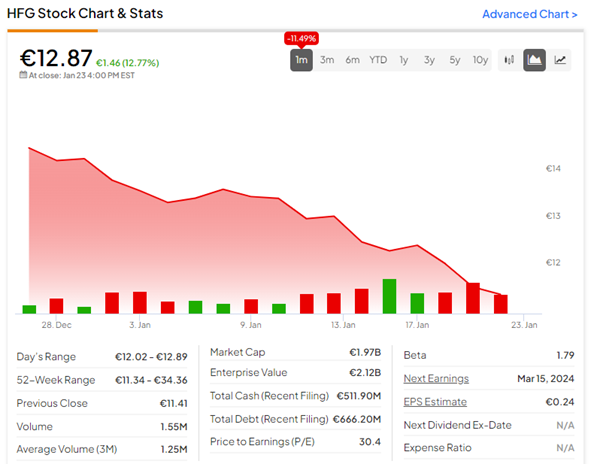

Shares of German food delivery company HelloFresh SE (DE:HFG) gained over 12% yesterday on receiving a rating upgrade from American research firm Morgan Stanley. Analyst Luke Holbrook upgraded HFG stock to Buy from Hold but reduced the price target slightly from €18 to €17 (32.1% upside potential).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Berlin-based HelloFresh delivers meal kits to over 7.1 million active customers worldwide. It has acquired and spread its business to different nations under brands such as Green Chef, Every Plate, Factor, The Pets Table, and Good Chop.

Reasons for Morgan Stanley’s Bullish Stance on HFG

Holbrook believes that the markets are undervaluing HFG’s Factor unit, which delivers ready meals in the U.S. HelloFresh bought Factor in 2020. Since then, the unit has become one of the core revenue generators for the company. Holbrook noted that Factor already has an over 50% market share in the U.S. ready meals segment. Plus, it has recently ventured into the Benelux markets (Belgium, the Netherlands, and Luxembourg), which will boost its European presence. The firm forecasts Factor’s revenues to grow 33% annually in FY24, 29% in FY25, and then double to €2 billion by FY27.

The analyst believes that Factor alone is supporting HelloFresh’s current market valuation. Based on yesterday’s closing stock price, HFG’s market capitalization is approximately €2.2 billion. As per Morgan Stanley, valuing Factor at 10x EBITDA (earnings before interest, tax, depreciation, and amortization) for 2025 indicates a fair value of €1.5 billion.

Is HelloFresh Struggling?

After the pandemic, the ready meals sector has witnessed a decelerating demand for at-home meal kit delivery. HFG shares have lost nearly 50% in the past year before the rating upgrade.

In November 2023, HelloFresh reduced its revenue growth and adjusted EBITDA targets for Fiscal 2023 owing to two reasons. Firstly, there were fewer new customer additions in the group’s U.S. meal kit business. Secondly, the group’s ready-to-eat capacity ramp-up activity took more time than expected, leading to lower sales.

Based on these HelloFresh now expects Fiscal 2023 revenue to grow between 2% and 5%. Meanwhile, adjusted EBITDA is expected between €430 million and €470 million. The company is set to release its Fiscal 2023 results on March 15, 2024.