Chinese automobile maker Geely Automobile Holdings (HK:0175) is ready to disrupt the country’s electric vehicle (EV) market with its Galaxy E8 model. On January 5, Geely launched the first model of Galaxy E8, an all-electric sedan. The E8 is one of the most economical cars in the Class B sedan segment, which is one of the largest EV segments in the mainland.

More on the Galaxy E8

The E8’s basic version will cost RMB 175,800, significantly lower than rival BYD’s Co. Ltd. (HK:1211) Han EV. The car’s latest selling price is also RMB 12,200 lower than its pre-sales tag listed on December 16, 2023. Geely CEO Gan Jiayue boasted that the E8 is foolproof in terms of “safety, design, performance and intelligence.” Plus, he thinks that the model will be an ideal substitute for the existing petrol, hybrid, and electric autos. Geely will begin delivering the Galaxy E8s in February this year.

The Galaxy E8 leverages the Qualcomm Snapdragon 8295 chip to support its features. It also boasts a 45-inch screen built by Chinese display panel manufacturer BOE Technology.

The Galaxy brand is Geely’s most affordable line-up of autos. Geely expects to make and sell up to seven models under the Galaxy brand by 2025. It already has two plug-in hybrids under this brand, the L7 SUV and the L6 sedan, both launched in 2023. China is undoubtedly the largest automobile and EV market in the world. As per Fitch Rating‘s report in November, sales of battery-powered autos in China are expected to grow by 20% in 2024. This would mark a slowdown from the 37% growth registered in 2023, as per the China Passenger Car Association‘s estimates.

What is the Prediction for Geely Stock?

Geely is a fast-growing auto company in China. Recently, Geely increased its sales volume target to 1.9 million units for 2024 after it exceeded its 2023 delivery estimates. The company is focusing on the transition to new energy vehicles (NEVs) and is on track to achieve its goal of selling 3.65 million NEVs by 2025.

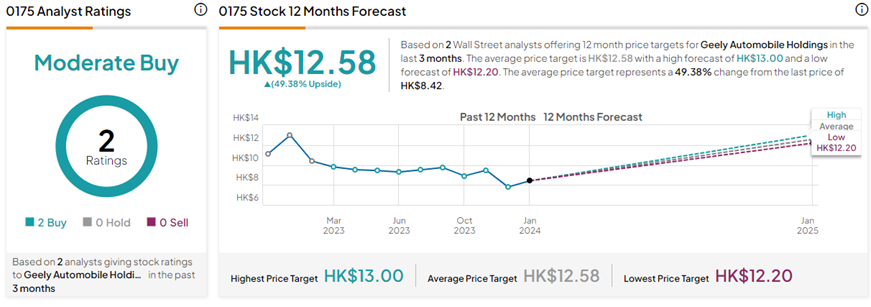

Based on two Buy ratings received during the past three months on TipRanks, 0175 stock has a Moderate Buy consensus rating. Further, the Geely Automobile Holdings share price target of HK$12.58 implies 49.4% upside potential from current levels.