Chinese automaker Geely Automobile Holdings (HK:0175) has increased its sales volume target to 1.9 million units for 2024 after it exceeded its 2023 delivery estimates. Geely sold 1,686,516 autos in 2023, which reflected an 18% growth and was above its original estimate of 1.65 million units. Geely’s 2024 target includes a 66% jump in the sales volume of new energy vehicles (NEVs) compared to 2023. Despite the good news, Geely shares are trading down by 2.7% as of the last check.

Geely Automobile is China’s second-largest carmaker by sales. The company is focusing on the transition to NEVs and is on track to achieve its goal of selling 3.65 million NEVs by 2025. In 2023, Geely sold 487,461 NEVs, up 48% over 2022. NEVs accounted for nearly one-third of Geely’s annual units sold last year.

Notably, Geely brand’s auto sales, which represent the largest chunk of the units sold, rose 16% year-over-year. Meanwhile, Lynk & Co. brand’s auto sales grew 22% annually, while Zeekr brand’s auto sales jumped 65%. Geely is also expanding its footprint globally through exports and opening stores across the Middle East, Asia-Pacific, Africa, Latin America, and pan-Europe. Geely’s exports rose 38% in 2023.

What is the Prediction for Geely Stock?

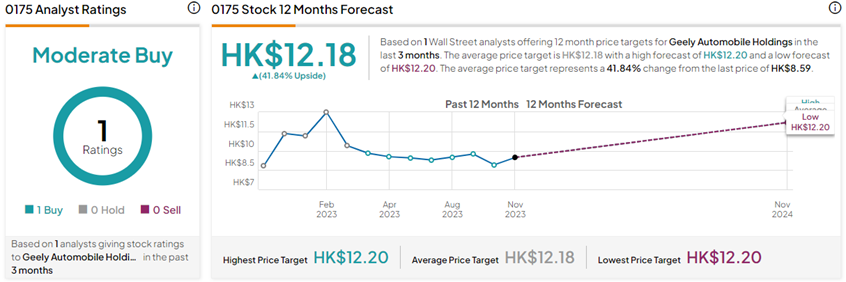

On TipRanks, 0175 stock has a Moderate Buy consensus rating based on one Buy rating received during the last three months. The Geely Automobile Holdings share price target of HK$12.18 implies 41.8% upside potential from current levels. 0175 shares lost 25.9% of their value in the past year.