The share price of the British retailer WH Smith PLC (GB:SMWH) tumbled by more than 6% despite the company posting revenue growth for FY23 in its trading update. The company stated that the growth was driven by the global surge in travel demand since the easing of pandemic restrictions. Nonetheless, the sector is still grappling with elevated costs and reduced passenger spending due to economic challenges.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The numbers came as an additional blow to the shares, which had already been trading in the red zone since the beginning of this year. Post-update, the stock went down by 6.41%, resulting in a total YTD loss of 7.47%. Analysts observed that the market was disappointed due to the lack of any revision or upgrade to the earnings forecast.

WH Smith is a global retailer specializing in travel items, stationery, entertainment products, etc. The company operates through two categories: Travel and High Street.

Let’s take a look at some of the numbers.

Trading Update

The company’s revenue saw a significant uptick of 28%, primarily due to a remarkable 42% increase in revenue from its travel segment. The Travel segment has demonstrated robust performance in the latter half of the year, with passenger numbers recovering in its main markets. For the full year, analysts expect the profit after tax to be around £143 million.

Throughout the year, the company inaugurated 20 new stores, which encompassed 8 new locations within hospitals, which performed well during the year. In the U.S. and the rest of its markets, the company continues to capture improved market share.

Moving forward in FY24, the company plans to open 80 new stores for its travel business, including 40 in North America.

The company will report its full-year earnings for FY23 on November 9.

Are WH Smith Shares Worth Buying?

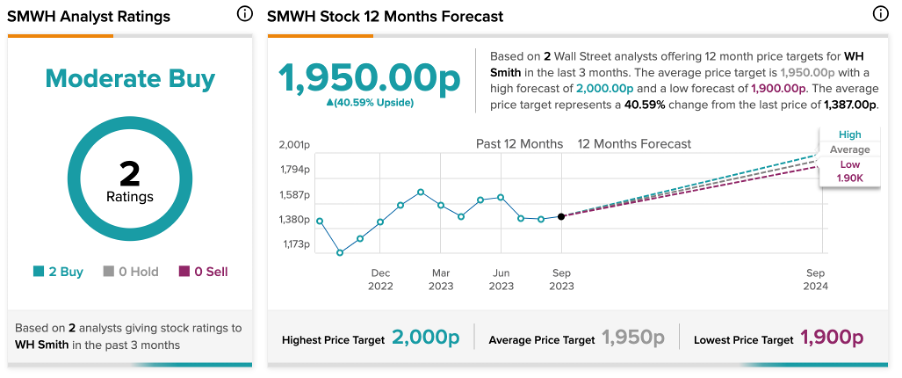

On TipRanks, SMWH stock has received a Moderate Buy rating based on two Buy recommendations. The WH Smith share price target is 1950p, which implies a huge upside potential of 40% from the current trading levels.

It’s worth mentioning that these ratings were assigned before the trading update and may be subject to revision in light of the positive figures.