The UK-based bakery retailer Greggs PLC (GB:GRG) yesterday announced its Q3 trading update, reporting increased sales and its record expansion plans for shop openings in 2023. The company maintained its robust trading performance in the third quarter of 2023, experiencing a 20.8% increase in total sales. Like-for-like sales in company-managed shops also saw a significant rise of 14.2% compared to the corresponding period in 2022.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Following a substantial surge in sales in recent months, the company is poised to achieve a record-breaking year of store openings. Greggs has experienced a net opening of 82 stores this year, bringing the total to 2,410 stores by the end of September. The bakery chain anticipates a further 135 to 145 net store openings by the end of the year.

Greggs is a prominent British retail chain known for its wide range of bakery items, including sausages, rolls, sandwiches, doughnuts, and more. With a vast network of over 2,400 outlets across the UK, the company serves approximately six million customers on a weekly basis.

Strategic Initiatives and Outlook

The company’s numbers showcased the favorable outcomes of its strategy focused on customer loyalty and increased opening hours. As a part of its customer attraction strategy, Greggs has focused on expanding its evening operations, with sales after 4 p.m. now contributing to 8.8% of its overall trade. Additionally, the company has witnessed a substantial rise in customer engagement through its mobile app and collaboration with Uber Eats.

In terms of outlook, the company has confirmed its full-year numbers to align with its earlier projections. The company is also confident that its robust product and promotional strategies in place for the fourth quarter and the expansion of our delivery service will enhance its accessibility to a broader customer base across various occasions.

Are Greggs’ Shares a Good Buy?

Despite the encouraging numbers, the Greggs share price traded down by 3.43% yesterday. Overall, in the last six months, the stock has experienced a decline of 11.3% in trading.

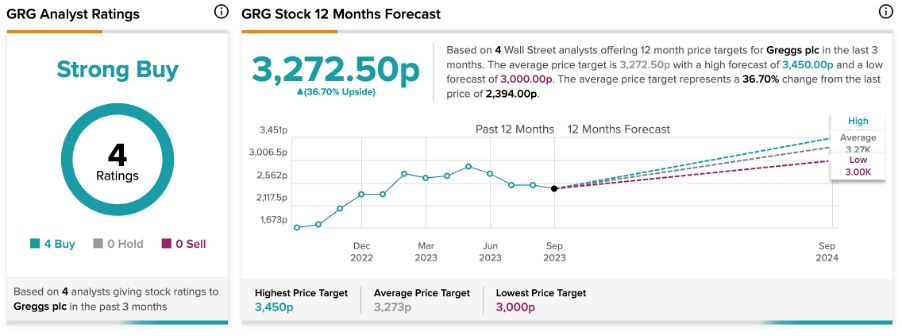

According to TipRanks’ analyst consensus, GRG stock has received a Strong Buy rating, backed by all Buy recommendations from four analysts. The Greggs share price forecast is 3,272.5p, which is 36.7% higher than the current price level. The price target ranges from a low of 3,000p to a high of 3,450p.