UK-based low-cost airline company easyJet PLC (GB:EZJ) posted solid numbers in its third-quarter earnings for 2023. The airline’s shares went down by 3.6% yesterday after the results announcement. YTD, the shares have generated huge returns of almost 50% after travel demand continued to rise.

Record Numbers

The company posted pre-tax profits of £203 million for the second quarter, which is significantly higher than the loss of £114 million in the same quarter last year.

During the quarter, the company reported 146,816 flights, up from 140,045 last year. The number of passengers jumped to 23,454,000 from 22,001,000 a year ago. The load factor witnessed an increase, rising from 88% to 90%. The ticket yields experienced a significant surge, rising by 22% year-on-year.

Overall, analysts are bullish on the European airlines and expect them to announce robust earnings this quarter, backed by higher travel demand. Bookings across the continent are reaching levels comparable to 2019, and growth is predicted to persist into the winter season as well.

Moving ahead, the company anticipates reporting a record pre-tax profit for its fourth quarter as costs per seat level off with stabilized oil prices. The airline’s positive outlook is bolstered by strong projections for the winter season, with year-on-year bookings on the rise and a planned capacity increase of over 15% scheduled for December.

Analysts’ View

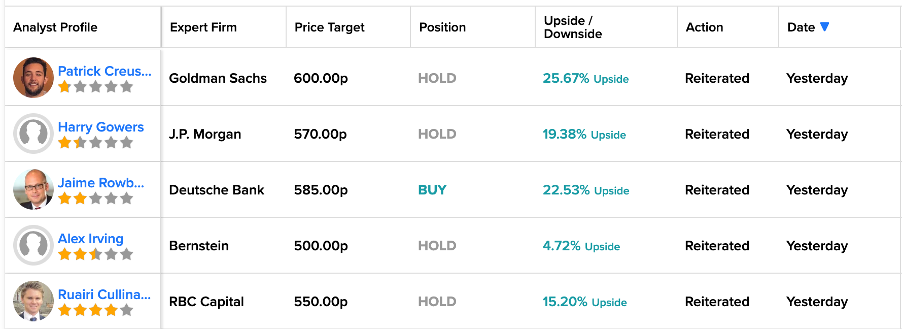

Post-results, four different analysts reiterated their Hold ratings on the stock yesterday. Among these, Patrick Creuset from Goldman Sachs has the highest price target of 600p, which is 25% higher than the current trading levels.

J.P. Morgan analyst Harry Gowers also confirmed his Buy rating on the stock, forecasting a growth rate of 18.7% in the share price.

Are easyJet Shares a Good Buy Now?

On TipRanks, EZJ stock has a Moderate Buy rating based on four Buy, five Hold, and one Sell recommendations.

The average target price of 591.8p implies an upside potential of 24% on the current trading price.